Estimating Roll's spread

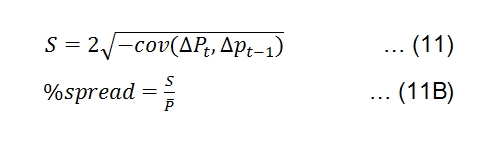

Liquidity is defined as how quickly we can dispose of our asset without losing its intrinsic value. Usually, we use spread to represent liquidity. However, we need high-frequency data to estimate spread. Later in the chapter, we show how to estimate spread directly by using high-frequency data. To measure spread indirectly based on daily observations, Roll (1984) shows that we can estimate it based on the serial covariance in price changes, as follows:

Here, S is the Roll spread, Pt is the closing price of a stock on day,

is Pt-Pt-1, and

, t is the average share price in the estimation period. The following Python code estimates ...

Get Python for Finance - Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.