Ranking stocks with the Calmar and Sortino ratios

The Sortino and Calmar ratios are performance ratios comparable to the Sharpe ratio (refer to the Ranking stocks with the Sharpe ratio and liquidity recipe). There are even more ratios; however, the Sharpe ratio has been around the longest, and is therefore very widely used.

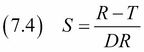

The Sortino ratio is named after Frank Sortino, but it was defined by Brian Rom. The ratio defines risk as a downside variance below a benchmark. The benchmark can be an index or a fixed return such as zero. The ratio is defined as follows:

R is the return of the asset, T the target benchmark, and DR the downside risk. The Calmar ...

Get Python Data Analysis Cookbook now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.