Chapter 4. Preliminary Planning: Can This Be a Success?

Few things are more deflating than putting forth a ton of effort that ultimately has little or no effect on the world around us. It’s like throwing a nice party and having nobody show up. If we develop a product, we want lots of people to use it! We want our product to be successful.

An important part of achieving success is choosing our battles wisely. Digging a tunnel to the Earth’s core with a teaspoon would be incredibly cool, but it would also be a fool’s errand. It ain’t gonna work. There are probably better adventures to set off on that are more likely to succeed.

One of the critical purposes of project planning is to help ensure that we’ve picked a winnable battle. As discussed previously, there are two fundamental parts to the product planning process that answer related questions:

-

If developed, does this product have a reasonable chance of being a success (however we define success)?

-

If it has a chance of success, what will it really take to develop this product (e.g., cost, timeline, people needed, etc.) so we can decide whether the return is worth the effort?

This chapter is about answering question 1. The basic idea is to do a fairly quick reality check to understand whether our product idea is worth pursuing further, or whether it can be ruled out as having an unacceptably low likelihood of ultimately succeeding. In particular, we’re looking for obvious showstoppers, but we’ll also do a few lightweight “sniff tests” to see if the business concept seems like it will work out.

Before we get going on the planning, I’d like to take a few paragraphs to introduce MicroPed, the product we’ll be developing in order to illustrate concepts as we move forward.

Introducing MicroPed

“For the things we have to learn before we can do them, we learn by doing them.”

Aristotle

Both as a student and as a teacher, I’ve found that learning works best through a mix of theory and reality. For example, E=mc2 is a nice little equation that tells us that a little bit of mass can convert to a lot of energy. But this concept really comes to life using examples, for example, that the mass in a single stick of chewing gum (one gram) can convert to as much energy as is needed to drive a car 14 million miles (at 25 mpg).

I’m not sure that there are too many product development concepts that can be illustrated as dramatically as E=mc2, but we’ll do what we can. Beginning in this chapter, we’ll track an actual project, a tiny wireless pedometer I’ve named MicroPed, to illustrate some of the real-world challenges faced in product development. While the MicroPed project will serve to catalyze the discussion, we’ll also expand its specifics into more-general ideas applicable to other products.

Let’s take a look at what we’re building.

Why Does the World Need MicroPed?

It’s said that necessity is the mother of invention. Appropriately, MicroPed was born from the needs of a frustrated pedometer user: me.

Like millions of other people, I enjoy using a pedometer to keep an eye on how much I’m moving around. I’ve owned several of these devices, but have yet to find one that’s ideal. What I really want is a pedometer that I don’t have to fuss with or even think about for months on end, but which tracks my walking and running all day, every day. I also want updates on my statistics available via smart phone, web browser, and so forth. I want it to fit easily in my wallet, which—unlike the pedometers I’ve owned—I always remember to take with me. And I want it to sit in my wallet for months, perhaps a year, without needing to be removed for battery replacement or recharge.

To my knowledge, no product currently marketed quite fits the usage model I’m looking for. Maybe there’s a reason for this: perhaps too few people want such a product, or it’s very difficult to develop or will cost too much to manufacture. But maybe there is a market for such a thing. I’d like to find out!

Can we build a product that will fulfill my wishes? And if we do, is there reason to believe we can make a profit? We’ll try to find first-order answers for these questions in this chapter after we define the product a bit more.

Before we dive in, a few notes about MicroPed are in order. Unlike most products whose goal is to earn a profit, MicroPed’s primary motivation is as a pedagogical tool to help illustrate the concepts in this book. I wanted a relatively straightforward development project that helps illustrate key technology points without requiring too much effort from me (hey, I’m writing a book and working at the same time!), and with minimal risk of surprises. It’s hoped that at a later date MicroPed will become a commercial product, but that’s a secondary (although not trivial) consideration.

Because of MicroPed’s goals and their priorities, some parts of the process, primarily on the nontechnical side, are significantly lighter than we’d find in a typical product, in particular:

-

Market research (testing the concept with users and getting feedback) is less rigorous than I’d want to see in a typical product. We’ll cover the basics, but there should typically be more rigor.

-

We won’t look for investment at the project’s start, nor will we discuss this topic in any detail. Dealing with investors and investment issues is often a big part of starting a new venture, although these days it seems more typical to seek investment after having a pretty good prototype. We’ll cover the financial fundamentals, but for startups there are other books to be read that can help. A few are listed in this chapter’s Resources section.

Now, let’s start creating MicroPed. As promised, we’ll start by defining something we think is technically feasible and will be accepted in the marketplace.

Marketing Requirements

Before we can do much planning, it’s important to define our product to some degree: less than a full design, but more than a vague concept. This helps us to:

-

Think through our product features, which can be important in understanding our potential markets, the costs of manufacturing our product, and some of the challenges that we’ll face in development.

-

Make sure that we’re on the same page with others we’re working with such as collaborators, potential customers, etc. In other words, we need to make sure they won’t be thinking Cadillac Escalade while you’re thinking Nissan Leaf.

The following wish list is a good start for MicroPed:

-

Small enough that I can comfortably put it in my wallet, or attach it to a shoelace and not have it annoy me.

-

Can operate for a year without needing any servicing, including battery charge or replacement.

-

Syncs data to smart phone, computer, smart watch, and so forth.

-

Waterproof, able to survive swimming and washing machines.

-

Can survive being run over by a car or truck.

-

Stores tracking data on a server (via smart phone or computer), which will be available from any web browser on the Internet.

-

Multiple MicroPeds living in different pieces of clothing and accessories can all be associated with a single user, so I don’t need to move a device from, say, wallet to running shorts. The backend system should understand that the data from all of my devices together is the aggregate record of my activity.

-

My data is my data. I want to be able to use the data I collect in any way I want without forking over a yearly fee.

-

My data is not your data. My data shouldn’t be available to advertisers, marketers, health insurers, the NSA, or anyone else unless I want them to have it for some reason.

-

Open source hardware and software. I want interested users to make MicroPed better with improved algorithms. Or they can customize MicroPed for new applications; there are dozens of potential uses for a device that has a processor, measures acceleration, and supports low-power RF communications, such as a sensing breaking glass, measuring heart beats (ballistocardiography), measuring the force of hits on football helmets, sensing when a baby’s fallen asleep, and so forth.

You’ll notice that this wish list is oriented toward usage rather than technology. Lists of high-level wants like these are sometimes called marketing requirements, because they ultimately encompass the claims that marketing folks will make, claims that can be understood by typical users. Later on, if our research convinces us to develop MicroPed, we’ll create another layer of technical requirements that get more specific about how these goals translate into unambiguous specifications, so that we all understand exactly what’s meant by “small enough that I can comfortably put one in my wallet” (which might translate to “no longer or wider than a standard credit card and no thicker than 4 mm”).

Marketing requirements in hand, we have a good idea of what our product will do for our customers. Next, let’s think about who those customers might be.

Target Markets

Since we’d like to profit by selling MicroPeds to customers, we should define who our prospective customers are so we can consider how many of them exist, and think about any other potential needs they might have. Determining the most important markets for a product is usually not too challenging, but it does warrant some thought—obviously, it’s best to pick markets that are larger, have a strong demonstrated need for our product, and have money to spend.

For MicroPed, our target markets will be:

-

People with an interest in fitness: athletes, exercisers, and anyone else who wants to keep track of their walking and running.

-

Makers/hobbyists/tinkerers (hereafter referred to simply as Makers) looking for an inexpensive programmable platform with an accelerometer and wireless connectivity.

At this point, we’ve defined our product and target markets at a high level. Now it’s time to do some research to see if this product and these markets are indeed a business opportunity.

Can It Make Money?

Before we sink our time and money into a development effort, it would be nice to know whether we’ll likely end up making money on the effort. Determining whether a new product is likely to be profitable can be a pretty sophisticated exercise if we examine all of the details and possibilities. It’s also a very imperfect art: even companies that spend millions determining whether a new product will be a winner can be well off the mark, sometimes spectacularly so: search the ‘net for Microsoft Bob, New Coke, Clairol “Touch of Yogurt” Shampoo, and/or Colgate Kitchen Entrees if you’d like to peruse some examples.

But while planning the “money stuff” is imperfect, it’s still pretty important. Among the things that it’s good for are:

-

Catching showstoppers like the need to set a prohibitively high price to cover the product’s development and manufacturing costs. If you’ll need to charge $386,000 per unit for your levitating kiddie car, you might want to think twice.

-

Giving us a sense of the potential upside for the product. Even if we do a great job, perhaps only a handful of people might need our product, so unless we can make a great deal of profit on each sale, we’ll have a problem.

Before we get to the actual numbers, let’s take a moment to define some terms and to map out some financial questions we’ll want to answer.

A Quick Look at the Money Stuff

While this is a book about technology, not accounting, our technology needs to meet financial needs to be a success, so let’s take a quick look. At a very basic level, most of us would agree that “making money” means that more money comes in the door from selling the product than goes out the door in developing and building the product.

Profit is more or less the name we give for income minus costs. Normally a product is intended to be profitable on its own. (There are occasional situations where a product is not intended to be profitable itself, but rather will serve a higher purpose that increases overall profits; e.g., a piece of test equipment that’s given away for free in order to drive sales of the disposable supplies needed to run the tests.)

Assuming that profit is an important goal, our task at this stage is to forget about development for short while, and to understand whether the product can be profitable once we’re manufacturing and selling it. If a product costs more to manufacture than we can likely sell it for, then it can never be a commercial success, and thus it’s not worth going through the substantial exercise of estimating development costs.

In this planning phase, we’ll identify all of the sources of income and costs directly associated with manufacturing and selling our product, and make some smart guesses as to what their values could be. With this information, we’ll construct a model that gives us some idea of whether we can come out ahead.

Income is pretty straightforward to calculate: it generally equals the number of units sold multiplied by the price of each unit. However, unless we’re developing the next generation of a product that’s already selling well, determining pricing is a challenge and predicting volume (number of units sold) is always a SWAG at best.

Total costs, on the other hand, has more components to it but is a bit more predictable. Roughly speaking, its components are:

-

The direct costs of manufacturing product: materials, cost of contract manufacturing, etc.

-

The costs of research and development

-

Ongoing costs such as paying salaries, advertising costs, customer support, rent, utilities, equipment, and supplies

-

Easy-to-forget-about-stuff like interest on loans, taxes, and depreciation

Doing a full prediction that takes all of these items into account requires a fair bit of work and is best done with the help of experienced accounting help once we know that we want to move forward with marketing our product.

But at this stage of the process, it’s not worth sweating all the details. We’re simply trying to get a quick feel as to whether the product makes even first-order financial sense once it is ready to sell. So, in this “back of the envelope” planning phase, we’ll look at just a few basic items:

Income:

-

How many units might we be able to sell?

-

How much might we be able to charge per unit?

Costs:

-

What will the product cost to manufacture?

-

Are there any technologies that will be expensive or impossible to develop or purchase, or any big (i.e., expensive) research projects required before we’ll know how to develop and manufacture our product?

Overall:

-

What’s our estimate for the product’s gross margin (percentage of our selling price left after paying for the direct cost of making a unit)? Is this gross margin consistent with gross margins of similar products?

If the answers to these questions look good in this first planning phase, then we’ll flesh out predictions for these and other prospective incomes and costs during the detailed planning phase.

Let’s start with the fun part: income!

Income Projections

There are many good reasons to spend some time thinking about the size of our potential markets, i.e., the number of units we can reasonably expect to sell. Beyond the obvious reason (selling more units means the potential for greater income), sales volume will also have a substantial impact on the cost of producing each device: usually the higher our production volumes (estimated annual units, EAU), the lower the unit cost for parts and assembly. So while it might be insanely expensive to build a sophisticated product in small quantities, larger quantities might be far more reasonable.

When gauging market size, it’s easy to fool ourselves by thinking about how cool and/or useful we think our product is, and how obvious this will be to everyone else. For example, the inventor of chicken goggles (US patent 730,918, shown in Figure 4-1) was probably dreaming of the many millions of chickens raised in the US each year, but might have failed to properly explore the question of whether any poultry farmer would actually want the things.

Figure 4-1. Patent 730,918, eye protector for chickens

The best way to do a quick check on the need for a product and the size of its market is to review the performance of existing products with similarities, since it will give us a feel for how many people have proven that they’ll spend money on something like what we’re selling and how much they’ve actually been willing to spend.

Even though we normally like to think of our product idea as revolutionary, almost all new products are broadly similar to existing products. For example, there’s general agreement that the original iPod was revolutionary, but that doesn’t mean there weren’t broadly similar products. Other personal digital music players existed at the time (albeit not-very-good ones), as did good cassette-based personal analog music players (i.e., the Walkman). In most cases, revolutionary can also be described as an evolution that’s so good it changes the playing field.

In MicroPed’s case, there are two prospective markets, and within each somewhat comparable products exist. Let’s see what these markets are and what they can tell us about MicroPed’s potential.

Activity tracker market

Nowadays, wireless pedometers are called activity trackers (even though they still mainly measure footsteps). The activity tracker market isn’t tiny, with well-known participants such as FitBit, Jawbone, Nike, Polar, and so on. For perhaps a year or more, my local Target and Best Buy have both had a good bit of aisle space dedicated to these products, so they must be selling a fair number of them.

Turning to the Internet for some more rigorous analysis, a pair of articles in MobiHealthNews, Fitbit shipped the most activity trackers in 2013 and Fitbit, Jawbone, Nike had 97 percent of fitness tracker retail sales in 2013 state that:

-

The “digital fitness tracker” market sold $238 million of product in 2013.

-

The market is at an early stage and growing rapidly; its size is expected to roughly double in 2014.

The articles’ data comes from NPD Group, a respected market research group that tracks sales at retailers, so these numbers are probably reasonably close to reality.

Given that these monitors sell for $50–$100 or so, the $238 million figure indicates that millions of units are being sold each year. So it looks like there’s a real market for products in MicroPed’s general category, and that market might well be growing rapidly.

So far, so good! There seems to be a significant market that’s buying millions of devices that are similar to ours each year, so we have a chance of success.

Note that if we wanted more details on this market, reports are available (known as market reports or market research reports) that provide more information and analysis. These tend to be pricey (often thousands of dollars) and sometimes of dubious value, but they can be helpful. A few small insights can translate into a lot of money, particularly when sales volumes are high. But in this case, since one of MicroPed’s purposes is to have a demonstration project for this book, I’m OK with simply knowing that there’s a good potential market (and keeping a few thousand dollars in my pocket).

The next question we should ask is whether, compared to competing products, our product has unique selling points (USPs) and key selling points (KSPs) that will make our product attractive to a substantial group of people. We won’t truly know the answer to this question until our product is on the market and selling, but there are several ways to get some pretty good indications.

Large companies tend to do extensive (and expensive) market research, which can be helpful. But one of the best ways to see if our product is attractive to consumers is to simply ask prospective customers whether they’d buy the product as we’re envisioning it. We can ask current users of competitive products whether they would purchase our product as an upgrade, or would have purchased our product instead of their current product if it had been available. We can also ask people who don’t own a competitive product if our product has features that would persuade them to buy it.

This kind of informal research can be tricky because people’s real behaviors might be different than the answers they give. For example, they might say positive things to avoid hurting our feelings. So it’s best to look for emphatic answers, such as “I’d buy that in a second. Let me know when it’s on the market!” rather than “I’d probably buy that.” In these situations, a verbal “probably will buy” usually means “probably won’t buy” in real life.

Crowdfunding sites such as Kickstarter and Indiegogo are another way to perform low-cost market research. On the plus side, these give us feedback on new product concepts that’s potentially much better than simply asking people if they’d buy our product: crowdfunding participants vote yes by ponying up real dollars so we know that a yes is really a yes. There’s also the obvious benefit of bringing in some money for development and manufacturing.

But crowdfunding isn’t a panacea; it also has important limitations. First, product development needs to be well along for a crowdfunding initiative to be successful. As of my writing this, all 10 of the 10 most-funded hardware products on Kickstarter had their industrial design and often much of their functionality in place before their campaign began. It’s much easier for customers to envision using a product if they can see it. Having something more substantial than a nice idea builds some confidence that the product’s development will be completed, and that ordered units will actually be manufactured and shipped.

Another issue with crowdsourcing is that it tests a specific way to sell a product to a specific group of people. Crowdfunding participants are early-adopter types that trend toward young adults, male, childless folks with higher-than-average incomes. This audience is perfect for cool gizmo types of products, but probably not as useful for selling, say, hearing aids.

Crowdfunding sites might also not be great arenas to test sales of items normally sold in standard online or bricks-and-mortar stores: products might sell better or worse when sitting alongside their competition as opposed to being on a crowdfunding site with a video and a page full of marketing copy.

We’ll be running a crowdfunding campaign for MicroPed once development is a little farther along, but alas, after this book is on the shelves. But for now, based on informal discussions with potential purchasers, it seems like the idea generates enough enthusiasm that we can have some confidence that a reasonable number of people will want it.

But at what price? How much can we expect consumers to pay? Next, let’s take a look at this important question.

Activity tracker selling price

Let’s get a feel for the price range that the market can tolerate for activity trackers by looking at what they currently do pay. Popping onto Amazon and searching for “wireless activity tracker,” I’m presented with devices that range in price from about $25–$150.

Since MicroPed has a unique set of features, it’s a little tough to determine with precision which specific activity tracker is most similar. At the high end, price-wise, are the Jawbone UP 24, FitBit Flex, and Misfit Shine—each at about $100–$125. They are like MicroPed in that they are quite small and don’t display actual numbers, but unlike MicroPed they’re worn on the wrist, and two of them have some indicators for the user to view (just a few LEDs to track basic progress). The UP 24, Flex, and Shine are rechargeable but must be recharged every week for an hour or so. By contrast, MicroPed will likely use a disposable battery, but that battery need only be replaced once a year, an operation that should cost $2 for the new battery and require a few minutes of effort.

At the lower end of the market at about $50 is the Fitbit Zip. The Zip is a significantly larger (but not huge) device that clips onto a belt, pocket, or similar. The Zip is like MicroPed in that it uses a disposable battery and claims a long battery life (six months). Unlike MicroPed, Zip has an LCD display (albeit of very low quality), but cannot fit in a wallet and is not waterproof.

None of these products are open/hackable like we’d like MicroPed to be, nor as flexible as MicroPed (e.g., fit in wallets, on a shoe, in the tiny watch pocket found on jeans, etc.). Only one, the Jawbone UP 24, is like MicroPed in not directly displaying any activity feedback at all—but the UP 24 is Amazon’s bestselling activity tracker as I write this and also the most expensive one that’s selling well, so needing a smart phone or computer to see reported information does not seem to deter consumers.

The price we can charge for MicroPed is not entirely clear, but based on our quick perusal of Amazon it seems that the $50–$100 range is reasonable. For reality-check purposes, let’s be conservative and go with $50. That way, any surprises on pricing are more likely to be good than bad.

The Maker market

The Maker market is a tougher market to quantify, in part because it’s extremely fragmented. One way to gauge potential market size might be to examine unit sales of Arduino and Raspberry Pi, two popular open platforms for DIY experimentation (Arduino is fully open; Raspberry Pi is open source only for software). Some Internet searching indicates that each of these platforms sells somewhere around a million units per year, so this is a nontrivial market.

However, these platforms are much more flexible than MicroPed and they’re designed as all-purpose “brains” to be used in conjunction with other circuitry to solve many different types of problems, and also as educational tools. MicroPed, by contrast, will be a specialized platform supporting only acceleration sensing and wireless communication, packaged up in an enclosure, so its Maker market is likely much more limited. It would probably be realistic to discount the Maker market size for MicroPed by 95% compared to these other products, so we’re looking at a potential market size of maybe 50,000 or so. Still not tiny, but much smaller than the activity tracker market.

We could do more research here, but it seems pretty likely that the Maker market is a good bit smaller for MicroPed than the activity tracker market. Makers looking for a device to hack could be a profitable market, or MicroPed’s hackability might make it attractive to Maker-ish folks who are looking for a tracker. In other words, when they decide to buy a tracker, they might veer toward MicroPed because it’s hackable.

Arduinos and Raspberry Pi’s sell for $10–$35, but since the activity tracker market will likely be more significant for us, it makes sense to allow the tracker pricing to predominantly drive MicroPed pricing and not go through the exercise of narrowing potential pricing for the Maker market at this point.

We now have some idea of what we should be charging for MicroPed. Next we’ll look at the other side of the profit equation and get a feel for how much it will cost to produce each unit.

Cost of Goods Sold

The cost to manufacture each copy of our product, technically known as the unit cost of goods sold, or COGS (pronounced like cogs on a gear), is a make-or-break calculation: obviously, the cost must be well below our selling price. Fortunately, COGS tends to be reasonably predictable compared to the other numbers that we’ll estimate at this early stage, but a good estimate will require some effort.

COGS includes just the direct cost to manufacture one unit, and does not include indirect costs such as R&D, salaries for management, sales and marketing, and so forth. Assuming that we use a contract manufacturer, COGS is fundamentally the cost of components plus the price we pay for assembly. Of these two, components are usually the larger cost, particularly for higher volumes and more complex devices.

Making a reasonable estimate of COGS requires having some idea of the components we’ll use so we can price those components and the cost of assembling them. And the only way to have an idea of which components we’ll use is to do some thinking about the product’s design. So this is the time when design/development begins, albeit in a very rough form.

Components, in turn, come in two basic varieties: electronic and mechanical. Software is typically not to be considered as part of COGS unless there is a unit licensing cost for each copy sold; e.g., for a commercial operating system.

In the case of products where mechanical parts merely form an enclosure that holds everything together, COGS is mainly dependent on the cost of electronics components and PCBA assembly. The enclosure will likely be composed of a few plastic injection-molded pieces that might be 10%–20% of the component costs, and will be relatively trivial to assemble. Creating the molds might be more expensive, but that is part of our R&D effort estimates later.

In products where mechanical components go beyond merely serving as an enclosure, particularly if they move with respect to one another during routine use, such as in robotic products, mechanical components become a much more important part of the cost and should be estimated carefully. Parts that move with respect to one another are known generically as mechanisms, and estimating the cost of mechanisms tends to be a challenging exercise best left to experts (and beyond the scope of this book).

MicroPed will serve as a good general example for estimating COGS when mechanical parts are only used as an enclosure, so let’s dig in.

MicroPed will ultimately consist of a system that includes the wearable unit we think of as the product, as well as related software running on smart phones, servers, and so forth. For the purpose of estimating COGS, we need only concern ourselves with the electronic and mechanical parts of the wearable unit because that’s the only bit that will incur a significant cost for each MicroPed unit we sell.

We’ll start our COGS estimate by laying out the electronics architecture of MicroPed’s hardware piece (the wearable). Then we’ll turn that architecture into some circuit building blocks, and estimate the cost of those blocks and of assembling them into a finished unit.

Preliminary electronics architecture

I’ve been involved in the design/development of many products that are similar to MicroPed, so developing an architecture is a pretty straightforward exercise for me. If it weren’t, I’d try hard to find some experts who’ve designed similar products to help out.

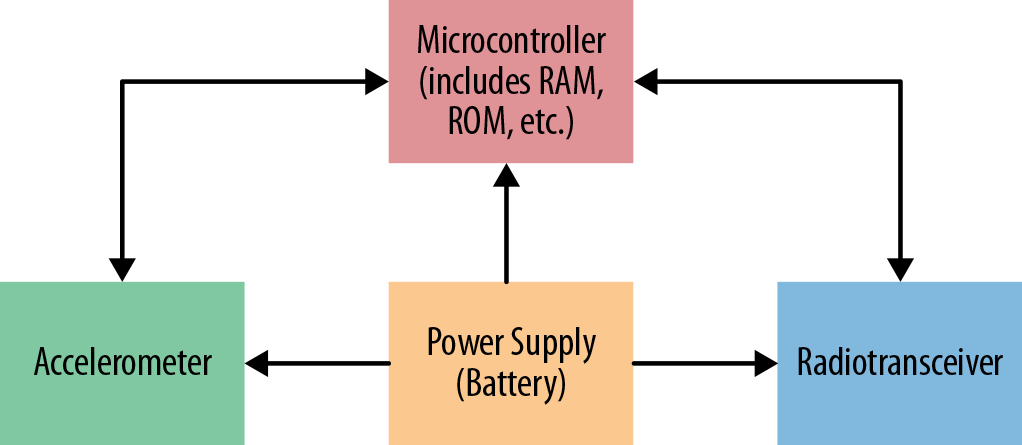

Fundamentally, activity trackers are simple devices: an accelerometer to sense movement, a wireless subsystem to transmit data to a receiver, some smarts to tie things together, and a power source. A block diagram of the MicroPed hardware is shown in Figure 4-2.

Figure 4-2. MicroPed wearable architecture

Materials costs

Since MicroPed looks to be a reasonably straightforward device—some electronic parts on a board in a simple enclosure—once we know the electronics architecture, we can get a pretty good estimate of the assembled cost. We simply estimate the cost of each building block within the architecture (which in practice usually translates to a chip or two), and add a little extra for the miscellaneous electronics “stuff” that we’ll need (resistors, capacitors, connectors, crystals), along with a battery and enclosure.

Table 4-1 shows a back-of-the-envelope-worthy estimate of the cost to manufacture MicroPed at several smallish quantities. A few notes:

-

In this case, each block in our architecture can readily be turned into a single chip (and the battery). As a rule of thumb, if a block requires that more than one or two chips be implemented, that block is probably too broadly defined and should be broken into smaller blocks.

-

The cost estimates for parts are based on a (reasonably educated) guess at the parts that we’ll be using, and a quick online perusal of pricing from vendors. Most parts vary substantially in cost, depending on the quantities purchased.

-

The standard name for a list of parts like this is the bill of materials, or BOM (pronounced like “bomb”). You’ll definitely want to refer to it this way when you talk to manufacturers and other folks who are “in the business.”

| Description | Qty 100 | Qty 500 | Qty 1,000 | Qty 5,000 |

|---|---|---|---|---|

| Bluetooth Low-Energy transceiver chip | 3.15 | 2.55 | 2.15 | 2.00 |

| Microcontroller | 2.90 | 2.35 | 2.00 | 1.95 |

| Accelerometer chip | 0.85 | 0.85 | 0.85 | 0.85 |

| Assorted discrete parts, WAG | 2.00 | 2.00 | 1.50 | 1.25 |

| PC board (2 layer), WAG | 3.00 | 2.00 | 1.00 | 1.00 |

| Disposable lithium battery | 0.30 | 0.25 | 0.23 | 0.20 |

| Enclosure, SWAG | 10.00 | 5.00 | 2.00 | 1.00 |

| Total BOM cost: | 22.20 | 15.00 | 9.73 | 8.25 |

Now let’s turn to the second part of the COGS equation, the cost of assembly. For a product like this that’s just a PCBA and a simple enclosure, I’ve found it reasonable and conservative to estimate the total cost of assembly (PCB assembly plus final assembly) as roughly the same as the BOM cost. In other words, doubling the BOM cost gives us the total COGS, as shown in Table 4-2. The contribution of assembly costs to COGS tends to drop in higher volumes and increase a fair bit for complex mechanical assemblies, but for back-of-the-enveloping this rule of thumb will do.

| Description | Qty 100 | Qty 500 | Qty 1,000 | Qty 5,000 |

|---|---|---|---|---|

| Total BOM cost (carried over from Table 4-1) | 22.20 | 15.00 | 9.73 | 8.25 |

| Cost of manufacturing | 22.20 | 15.00 | 9.73 | 8.25 |

| Unit COGS: | 44.40 | 30.00 | 19.46 | 16.50 |

So all told, it looks like the cost of each unit will be $15–$20 per unit in quantities greater than 1k units. To be conservative, we’ll use $20 for planning purposes.

We now have some idea of what we can charge for our product, and of how much it will cost to make each one. Fortunately, it seems like we can charge more for MicroPed than they’ll cost us, which is necessary for success but perhaps not sufficient. We also need to know whether the spread between cost and price is enough to sustain all of the other aspects of our business beyond manufacturing product, such as salaries, rent, and so forth. That’s the next question we’ll tackle.

Gross Margin

The percentage difference between a product’s selling price and its COGS is known as its gross margin. Gross margin represents the money from which we’ll need to cover all of our expenses other than COGS, such as salaries for folks not directly involved in manufacturing, rent, utilities, backend IT infrastructure, paying back the cost of research and development, etc. And if we have some margin left over after paying all of our expenses, we’ll have our sought-after profit.

How much gross margin is adequate to pay for these things? Because different companies in the same industry tend to have similar types of expenses, products within an industry tend to have similar gross margins. But gross margins between different industries vary quite a bit, because their businesses operate differently.

Typical gross margins for a given industry can be found with a little research. For example, gross margins on software tend to be high—usually 75% to 100%—because the cost of the materials sold is so low (often just a software download or web page click, at a cost of roughly zero), but software makers need plenty of margin to cover their considerable research, development, and maintenance expenses.

On the other end of the spectrum, gross margins at gas stations are way down in the 10% range. Why is a gas station at 10% and not, say, 20%? The reason is that the gas station doesn’t need to do very much work (or spend very much money) in order to deliver gas from their storage tank to your car. Almost all of their expense is in buying the gasoline for resale (COGS). If one station raises their prices higher to increase gross margin, then their prices will be higher than the station down the street and they’ll lose business. Basically, gas is gas and people won’t pay a lot extra for one brand versus another.

Because gross margins tend to run at similar levels for most companies (and thus for their products) in the same industry, estimating the gross margin for a prospective product can be a good “sniff test” to see if a product “smells” like similar products in a financial sense.

In the case of MicroPed, we’ve estimated a selling price of $50 and a $20 unit COGS, giving us a gross margin of 60% ([$50–$20]/$50).

For consumer electronics, which MicroPed will be nominally a part of, gross margins tend to be in the 30%–50% range. For example, in 2012, Apple Computer’s gross margin across the company was 44%. So our guesstimated 60% margin on MicroPed is roughly in the right ballpark. If it were far lower, we’d have to wonder if it could cover all of our expenses. Higher margins are always nice if we can get ‘em, although products with margins that are too high might well get undercut by lower-priced competitors at some point.

We don’t yet know for sure if MicroPed’s margins will pay for all of our expenses and recoup R&D costs. That’s something we’ll look at in our next phase (detailed planning), but so far, so good: we certainly won’t obviously lose money on each unit we sell, and the numbers seem reasonable for our industry.

Our gross margin calculations so far assume that we’re selling directly to a consumer. But what if we sell through distributors and/or retailers, and have to discount our price to them to accommodate their markups? Retailers purchase product at a discount, typically 15% to 33% off the selling price.

So unless we’ll only be doing direct sales, our retail price should be high enough to support a reasonable margin after the retailer takes their cut. If we assume a bad case of a 33% discount to retailers, then our wholesale price would need to be $33.50 for the retailer to support a $50 price to the consumer. At a unit COGS of $20 and a wholesale price of $33.50, MicroPed’s gross margin is reduced to about 40%. A 40% margin isn’t nearly as good as a 60% margin, but still within the 30%-50% common for consumer electronics.

However, if we sell through retailers we’ll likely also be selling more product, so COGS will probably drop, restoring some of our margin. Unit COGS can come down very substantially if we end up manufacturing in much larger quantities, say 100,000 or more per year. In this scenario, both the BOM and manufacturing costs will likely dive. It would not be shocking if our unit COGS went to $10 in very large quantities. In this case, unit gross margin would go to about 80% (!) if we sell direct, or about 70% if we sell through retailers.

To sum up, it looks like once we start producing MicroPed, we have a pretty good shot at being profitable. But before we produce a product, we need to develop it. Our next step is to do a quick check on the feasibility of developing our product: does development seem straightforward, or do we have a good chance of bumping into trouble?

Can We Develop It?

Fundamentally, development (and research) are long-term investments. We spend time and money to create a product in the hope that we’ll eventually earn enough to recoup the investment and earn some profit above that.

In the detailed planning phase of our project (Chapter 5), we’ll prepare a development plan with costs that are hopefully in the ballpark of reality. But for now, it’s useful to look at one question in particular: does our device require any technologies that we’re not likely to be able to develop, buy, or otherwise obtain? This unobtainable content is sometimes called unobtanium, and can take various forms:

-

Things that violate the laws of physics as we know them. For example, creating a cell phone powered by the body heat in our hands and pockets is pretty unlikely, because the thermal energy available is so tiny that even if it were 100% converted to electricity, that electric energy would be insufficient to produce the RF energy needed to make calls, light an LCD screen, etc. Energy can be converted from one form to another, but we can’t make more energy from less by wishful thinking.

-

Things that exist, but don’t exist for us. If Acer needs a beautiful custom 15” LCD panel that costs less than $50, they can get it, because they’ll buy millions and millions of them. But for the vast majority of us, asking an LCD panel vendor for such a thing will yield little more than a chuckle.

-

Things that don’t yet exist and don’t violate the laws of physics, but which are prohibitively expensive to pursue. For example, a reliable, sturdy, reusable heat shield to protect our personal spacecraft during re-entry into Earth’s atmosphere.

Unobtanium is, of course, viral: if a product requires any of it, then the entire product itself becomes unobtanium. We must either work to cleverly remove any need for the stuff, or move on to another product idea. In most cases, I’ve found that ideas that require unobtanium can be reworked to remove that dependency, usually through some fun, outside-the-box creativity.

So it’s obvious that we don’t want to rely on unobtanium. But how do we know if our product needs it?

Identifying Unobtanium

Unobtanium tends to hide in the parts of a project that contain unknowns and risks. Thus, a useful way to identify a lurking need for unobtanium is to list each of the significant technical unknowns and risks in a project, and the reasons we should or shouldn’t worry too much about them. For example, for MicroPed, Table 4-3 shows a few of the risks that I’ve identified:

| # | Risk | Unobtanium? | Next steps/mitigation |

|---|---|---|---|

| 1 | Full year of life from a battery | Probably not, based on widespread marketing claims from chip makers and from personal experience. | Create an energy budget; select parts that accommodate the energy budget; measure power consumption on prototypes in all modes; potential HALT (highly accelerated life-cycle testing); resize battery if needed. |

| 2 | Waterproof | No; it’s been done, but is easy to mess up. | Consult with mechanical engineers who’ve developed small waterproof enclosures; testing. |

| 3 | Run-over proof | No, from experience. | Develop CAD models of enclosure using a tool that can model stress; testing. |

| 4 | Burden of supporting Makers who have difficulty modding the firmware. | Not impossible; companies like MakerShed, Adafruit, SparkFun, and so forth do this. But it still could be a substantial burden. | Use standard Arduino hardware/firmware/software to take advantage of community support; set up support website before launch. |

Again, this is good news. MicroPed is a relatively straightforward product, and it doesn’t seem as if there are any features that can’t be done, or that are overly risky. But our exercise has caught a few issues that might be problems if not addressed properly, and we’ve come up with some tasks to reduce the chance of them tripping us up. We’ll be sure to build these tasks into our detailed project plan should we decide to move forward on MicroPed.

Now that we’ve identified any potential for technology showstoppers, we should have a pretty comprehensive first-cut understanding of our product’s feasibility. It’s time to put our findings together to answer this phase’s final question: should we go for it?

Go? No Go?

I remember watching the Apollo manned space missions as a little kid. At Mission Control (the folks on the ground who worked with the astronauts) sat a group of people called flight controllers who each represented a different system or specialty within the spacecraft or the mission: Booster (the rocket), FIDO (Flight Dynamics Officer, responsible for the rocket’s path), Surgeon (medical), Network (the radio networks for communication between capsule and ground), and so forth. Before launch or other major mission milestones, the Flight Director would ask each controller for go/no-go status:

“Booster?” “Go!” “Retro?” “Go!” “FIDO?” “Go!”, and so on, all the way down the line.

If all systems were “Go!”, they went. A “No-Go” meant that something had to change before proceeding.

Perhaps it’s the Walter Mitty in me, but I think of the close of this first planning phase as a miniature version of the Mission Control status check. For MicroPed:

“Do we have evidence that we can sell some?” “Go!” “At a price that might make it profitable?” “Go!” “Gross margin looks reasonable?” “Go!” “Development looks like it’s feasible?” “Go!”

All systems Go! We now have some confidence that developing MicroPed isn’t obviously a fool’s errand and that it’s worth moving forward into the detailed development planning phase, which we’ll tackle in our next chapter.

Get Prototype to Product now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.