Self managed superannuation funds

In Australia, there is a legal requirement for employers to pay a proportion of their employees’ salary into each employee’s choice of retirement fund, or superannuation fund. This is known as the superannuation guarantee. Investors can choose from several types of superannuation funds to invest in, but for ultimate control, and the flexibility to invest directly in almost any asset class, a self managed superannuation fund (SMSF) is the most viable option.

SMSFs are becoming increasingly popular in Australia, and offer particular advantages for investing in both property and shares. More and more Australians are taking advantage of the opportunities that SMSFs provide, which is flexibility and control, and, as you will see later in this round, SMSFs offer some very attractive tax benefits to investors, particularly when they have retired.

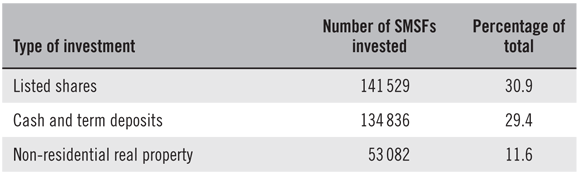

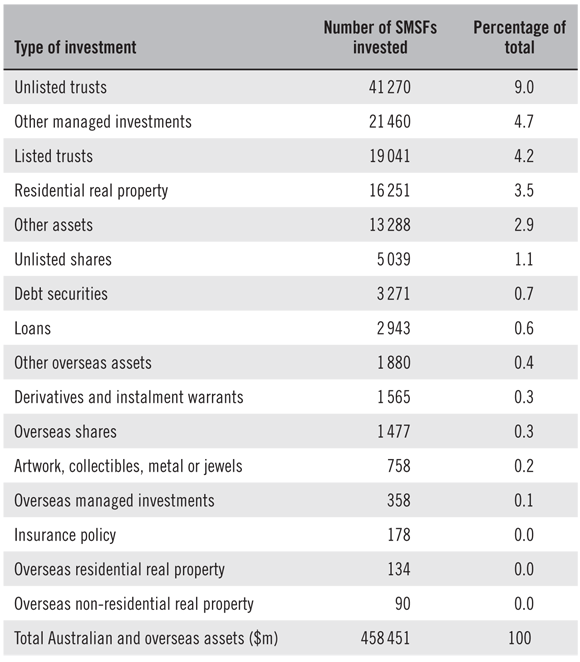

According to tax office statistics released in September 2012, there were nearly 481 000 SMSFs in existence, most of which invested in listed shares and cash (see table 15.1).

Table 15.1: range of investments held by SMSFs, 2012

What is an SMSF?

An SMSF is a superannuation fund that has one to four members ...