CHAPTER 2Overview of Project FinanceThe Nature of the Beast

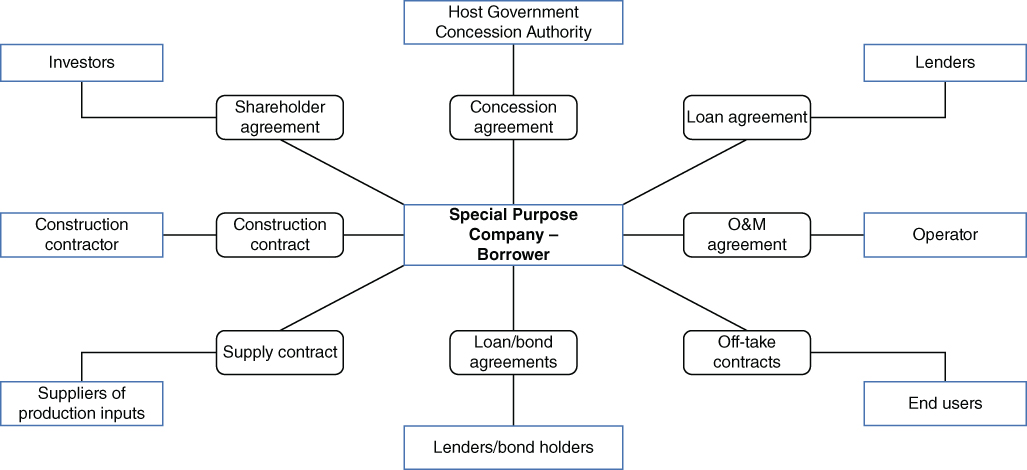

Different models are used for various types of project structures, but a typical project finance model is shown in Figure 2.1, whose central features are equivalent across project finance deals. That is, there are almost the same project participants, similar issues and concerns, comparable processes, and the variants of basic project structuring, financing methods, and instruments. In the basic project finance structure illustrated here, the different participants involved and the agreements necessary to hold the structure together are shown. Details about project participants and their roles and responsibilities are elaborated on in Chapter 7 and the contracts involved are discussed in Chapter 9.

Figure 2.1 Typical Project Finance Structure

Source: Adapted from Merna, Chu, and Al Thani (2010).

Project finance is well suited for funding infrastructure projects and it is especially useful in the case of projects in developing countries that may not be able to finance such projects in other ways. But to work well, there are some prerequisites that must be satisfied and include the following conditions:

- A stable political, regulatory, and investment environment in the host country

- Well‐working global markets in a normal functioning environment and accessible financing

- Adequate industry structure, license protection, ...

Get Project Finance for Business Development now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.