EXERCISE 9-7

| Purpose: | (L.O. 4) This exercise will (1) illustrate several different ways in which you may dispose of property, and (2) discuss the appropriate accounting procedures for each. |

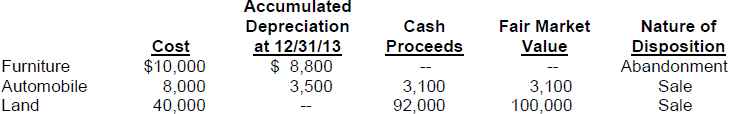

Presented below is a schedule of property dispositions for Barbara Steiner Co. during 2014:

SCHEDULE OF PROPERTY DISPOSITIONS

The following additional information is available:

Furniture. On January 1, 2014, furniture was tossed out in the dumpster because it was no longer adequate to serve the company's needs. It cost $10,000 when it was acquired. Depreciation of $8,800 was taken in prior years.

Automobile. On January 2, 2014, an automobile was sold for $3,100 cash. It had a cost of $8,000, and total depreciation recorded prior to the sale date amounted to $3,500.

Land. On February 15, 2014, land previously used in operations was subdivided and a section was sold for $100,000. A commission of $8,000 went to a real estate agent. The original cost of that land segment was $40,000.

Instructions

Prepare the appropriate journal entry for each of the dispositions. Show computations where appropriate.

TIP: The disposal of property, plant, and equipment should be accounted for as follows:

- The book (carrying) value at the date of the disposal (cost of the property, plant, and equipment less the accumulated depreciation) should be removed from the accounts.

- The cash (or other assets), if any, ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.