SOLUTION TO EXERCISE 9-5

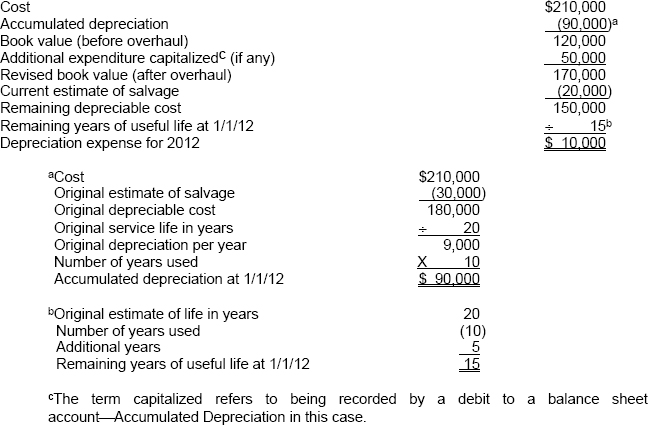

Approach: Whenever you have a situation that involves a change in the estimated service life and/or salvage value of a depreciable asset, use the format shown below to compute the remaining depreciable cost and allocate that amount over the remaining useful life using the given

TIP: A change in the estimated useful life and/or salvage value of an existing depreciable asset is to be accounted for prospectively; that is, there is no correction of previously recorded depreciation expense. Therefore, the book value at the beginning of the period of change, less the current estimate of salvage, is to be allocated over the remaining periods of life using the appropriate depreciation method. The book value at the beginning of the period of change is calculated using the original estimates of service life and salvage value. Using the straight-line method, the new annual depreciation is determined by dividing the remaining depreciable cost by the remaining useful life.

TIP: The $50,000 cost of overhaul is capitalized in this case because the cost benefits the future periods by extending the useful life of the machine.

TIP: Be careful when computing the length of time between two dates. The length of time between the end of 2001 and the beginning of 2012 is 10 years; whereas, the length of time between the beginning of 2001 and the beginning of 2012 is 11 years and ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.