SOLUTION TO EXERCISE 8-2

Explanation

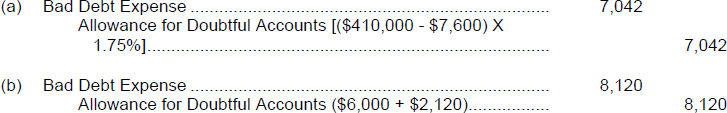

- The percentage-of-net-credit-sales approach to applying the allowance method of accounting for bad debts focuses on determining an appropriate expense figure. The existing balance in the allowance account is not relevant in the computation.

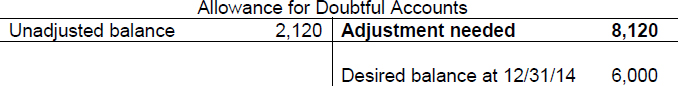

- An aging analysis provides the best estimate of the net realizable value of accounts receivable. By using the results of the aging to adjust the allowance account, the amount reported for net receivables on the balance sheet is the cash (net) realizable value of accounts receivable. It is important to notice that the balance of the allowance account before adjustment is a determinant in the adjustment required. The following T-account reflects the facts used to determine the necessary adjustment.

TIP: Notice that in this particular instance, the allowance account has an abnormal balance before adjustment. The normal balance of the Allowance for Doubtful Accounts is a credit. Therefore, a debit balance in this account indicates an abnormal balance. It is not uncommon to have a debit balance in the allowance account before adjusting entries are prepared because individual accounts may be written off at various times during a period, and the entry to adjust the allowance account is made at the end of the period ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.