EXERCISE 7-5

| Purpose: | (L.O. 7) This exercise will help you review situations that give rise to reconciling items on a bank reconciliation and identify those which require adjusting entries on the depositor's books. |

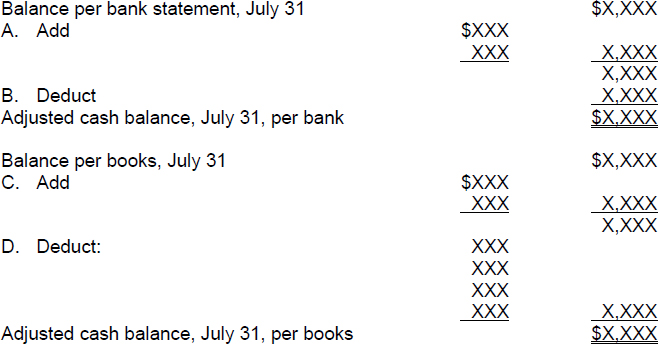

A sketch of the bank reconciliation at July 31, 20XX for the Ace Electric Company and a list of possible reconciling items appear below.

Ace Electric Co.

BANK RECONCILIATION

July 31, 20XX

| (a) | Items |

| ________ | 1. Deposits of July 30 amounting to $1,582 have not reached the bank as of July 31. |

| ________ | 2. A customer's check for $140 that was deposited on July 20 was returned NSF by the bank; return has not been recorded by Ace. |

| ________ | 3. Bank service charge for July amounts to $3. |

| ________ | 4. Included with the bank statement was check No. 422 for $702 as payment of an account payable. In comparing the check with the cash disbursement records, it was discovered that the check was incorrectly entered in the cash disbursements journal for $720. |

| ________ | 5. Outstanding checks at July 31 amount to $1,927. |

| ________ | 6. The bank improperly charged a check of the Ace Plumbing Co. for $25 to Ace Electric Co.'s account. |

| ________ | 7. The bank charged $8 during July for printing checks. |

| ________ | 8. During July, the bank collected a customer's note receivable for the Ace Electric Co.; face amount $1,000, interest $20, and the bank charged a $2 collection fee. ... |

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.