ANALYSIS OF MULTIPLE-CHOICE TYPE QUESTIONS

- Question

(L.O. 1) At December 31, 2014, a physical count of merchandise inventory belonging to Klintworth Corp. showed $500,000 to be on hand. The $500,000 was calculated before any potential necessary adjustments related to the following:

- Excluded from the $500,000 was $80,000 of goods shipped FOB shipping point by a vendor to Klintworth on December 30, 2014 and received on January 3, 2015.

- Excluded from the $500,000 was $72,000 of goods shipped FOB destination to Klintworth on December 30, 2014 and received on January 3, 2015.

- Excluded from the $500,000 was $95,000 of goods shipped FOB destination by Klintworth to a customer on December 28, 2014. The customer received the goods on January 4, 2015.

The correct amount to report for inventory on Klintworth's balance sheet at December 31, 2014 is:

- $572,000.

- $595,000.

- $675,000.

- $747,000.

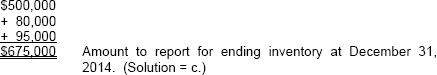

Explanation: - The $80,000 should be added to the $500,000 because FOB shipping point means the title transferred when the goods left the seller's dock on December 30, 2014.

- The $72,000 is properly excluded from the ending inventory because title did not pass to Klintworth until Klintworth received the goods on January 3, 2015.

- The $95,000 should be added to the $500,000 because the goods belong to Klintworth until they are received by the customer (in 2015)

- Question

(L.O. 3) Which inventory ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.