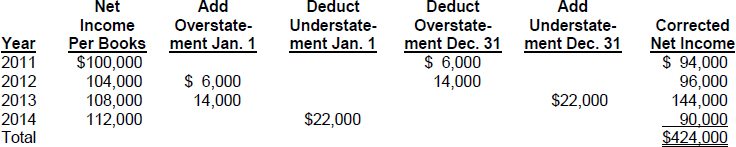

SOLUTION TO EXERCISE 6-6

Approach and Explanation: When more than one error affects a given year (such as in 2012), analyze each error separately then combine the effects of each analysis to get the net impact of the errors. The beginning inventory for 2012 (ending inventory for 2011) was overstated by $6,000. Therefore, cost of goods sold was overstated by $6,000, and net income for 2012 was understated by $6,000. The ending inventory for 2012 was overstated by $14,000. Therefore, cost of goods sold was understated, and net income for 2012 was overstated by $14,000. An understatement in net income of $6,000 and an overstatement of $14,000 in 2012 net to an overstatement of $8,000 for the net income figure reported for 2012. This overstatement of $8,000 combined with the $104,000 amount reported yields a corrected net income figure of $96,000 for 2012.

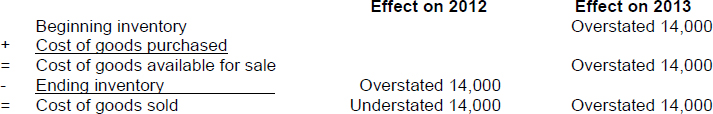

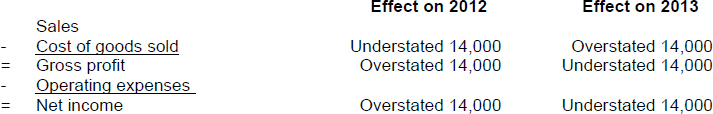

Another way of analyzing the effects of an individual error is illustrated below for the $14,000 overstatement of inventory at the end of 2012.

Thus, the previously computed net income figure for 2012 must be reduced by $14,000 to correct for this error. Also, the net income figure for 2013 must be increased by $14,000 to correct for ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.