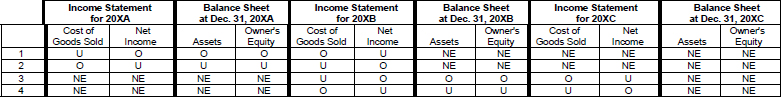

SOLUTION TO EXERCISE 6-5

Explanation: The following points are relevant:

- The proper determination of the amount to report for inventory is vital to the preparation of both the balance sheet and the income statement. Any misstatement of the ending inventory value has a direct impact on the total of current assets (and total assets) on the balance sheet. This misstatement of inventory will cause a similar misstatement (overstatement or understatement) of the net income calculation on the income statement. The misstated net income figure will cause a similar misstatement of the amount of owner's equity on the balance sheet (because net income is closed to the owner's capital account which is an owner's equity account).

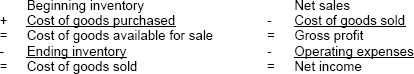

- Due to the manner in which the inventory balance at the balance sheet date is used in the calculation of the cost of goods sold, an inventory error will result in errors in the cost of goods sold, gross profit, and net income figures. As a review, the cost of goods sold and net income computations are:

- If ending inventory for Year A is overstated, the following effects on Year A will result:

- (a) Cost of goods sold for Year A will be understated.

- (b) Gross profit for Year A will be overstated.

- (c) Net income for Year A will be overstated.

- (d) Inventory on the balance ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.