EXERCISE 6-3

| Purpose: | L.O. 2, 3) This exercise reviews the computations that you must make when you use the LIFO, FIFO, and average cost methods to determine inventory cost. |

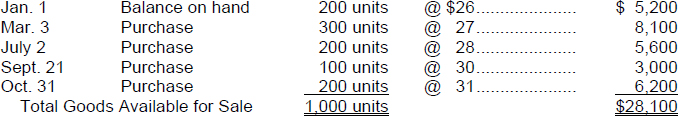

The following information pertains to the inventory of the Jeff Wilson Sales Company:

The selling price of Wilson's product was $48 for the first six months of the year and $50 for the last six months of the year. Total sales amounted to $29,300. A physical count of the inventory on December 31, 2014 revealed that 400 units were on hand.

Instructions

Compute the amount of (1) ending inventory for the December 31, 2014 balance sheet, (2) cost of goods sold for the 2014 income statement, and (3) gross profit for the 2014 income statement using each of the following inventory cost flow methods:

- (a) FIFO.

- (b) LIFO.

- (c) Average cost.

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.