SOLUTION TO EXERCISE 3-5

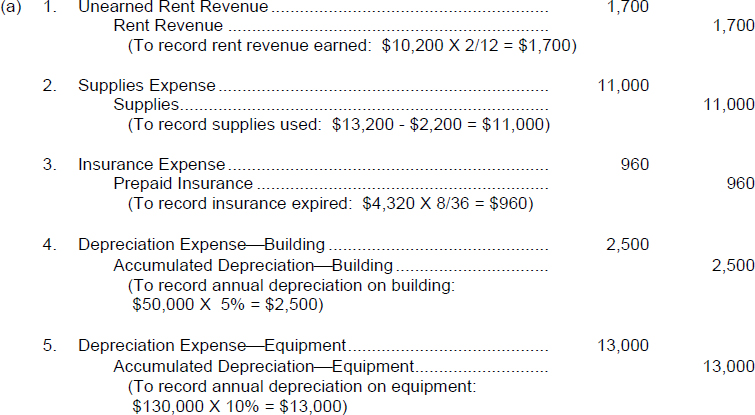

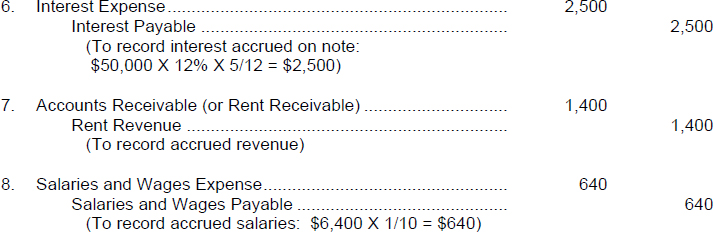

Approach and Explanation: Identify each item as involving: (1) a prepaid expense, (2) an unearned revenue, (3) an accrued revenue, or (4) an accrued expense. From the facts, determine the existing account balances. Read the facts carefully to determine the desired account balances for financial statements in accordance with generally accepted accounting principles (cost principle, revenue recognition principle, expense recognition (matching) principle, etc.). Determine the adjusting entries necessary to bring existing account balances to the appropriate account balances.

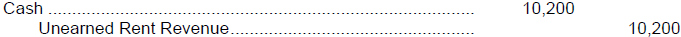

- On November 1, 2014, cash was received and recorded as follows:

This situation involves unearned revenue. At December 31, 2014, before adjustment, there is an Unearned Rent Revenue account with a balance of $10,200. The amount unearned at that date is $10,200 X 10/12 = $8,500. Therefore, an adjusting entry is necessary to transfer the $1,700 earned from the Unearned Rent Revenue account to an earned revenue account.

- This situation involves a prepaid expense. All supplies are charged to an asset account, Supplies, when purchased. Therefore, Supplies has an unadjusted balance of $13,200, which ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.