EXERCISE 3-5

| Purpose: | (L.O. 5, 6, 7) This exercise will illustrate the preparation of adjusting entries from an unadjusted trial balance and additional data. |

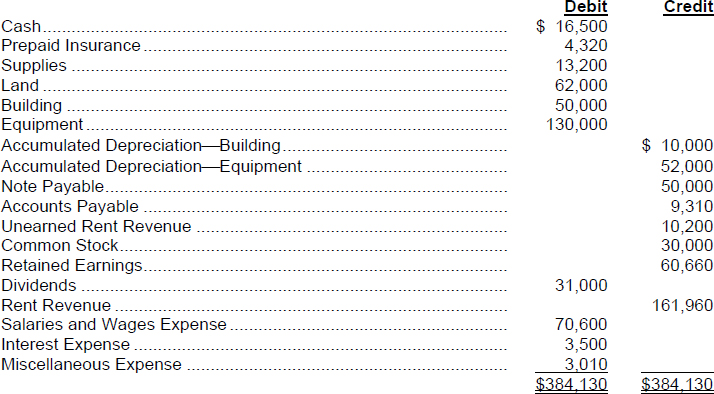

Tammy Equipment Rentals, Inc. began business in 2010. The following list of accounts and their balances represents the unadjusted trial balance of Tammy's Equipment Rentals, Inc. at December 31, 2014, the end of the annual accounting period.

TAMMY's EQUIPMENT RENTALS, INC.

Trial Balance

December 31, 2014

Debit Credit

Additional data:

- On November 1, 2014, Tammy received $10,200 rent from a lessee for a 12-month equipment lease beginning on that date and credited Unearned Rent Revenue for the entire collection.

- Per a physical inventory at December 31, 2014, Tammy determines that supplies costing $2,200 were on hand at the balance sheet date. The cost of supplies is debited to an asset account when purchased.

- Prepaid Insurance contains the premium cost of a policy that is for a 3-year term and was taken out on May 1, 2014.

- The cost of the building is being depreciated at a rate of 5% per year.

- The cost of the equipment is being depreciated at a rate of 10% per year.

- The note payable bears interest at 12% per year. Interest is payable each August 1. The $50,000 principal is due in full on August 1, 2017.

- At December 31, 2014, Tammy has some equipment in the hands of renters who have used the equipment but have not yet been ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.