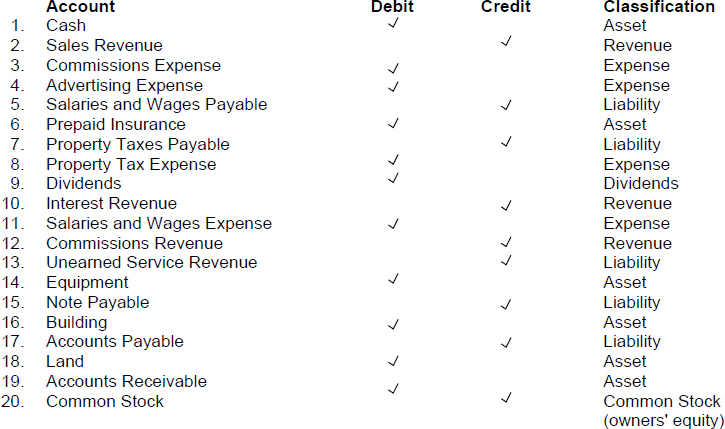

SOLUTION TO EXERCISE 2-1

Approach: Determine the classification of the account (asset, liability, common stock, retained earnings, dividends, revenue or expense). Think about the debit and credit rules for that classification.

TIP: Increases in assets are recorded by debits. Because liabilities and stockholders' equity are on the other side of the equals sign in the basic accounting equation, they must have debit and credit rules opposite of the rules for assets. Therefore, a liability or a stockholders' equity account such as Common Stock or Retained Earnings is increased by a credit entry. Revenues earned increase retained earnings so the rules to record increases in revenue are the same as the rules to record increases in the Retained Earnings account (increases are recorded by credits). Because expenses and dividends reduce retained earnings, they have debit/credit rules which are opposite of the rules for the Retained Earnings account.

TIP: A separate account should exist in the ledger for each item that will appear on the financial statements.

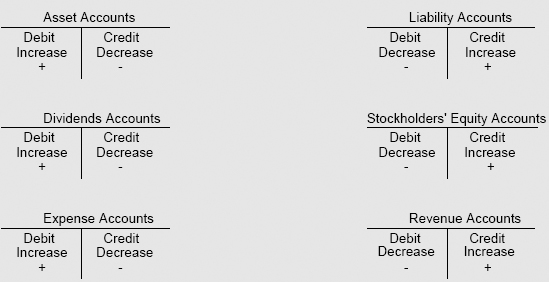

The debit and credit rules are summarized below:

Notice that the accounts are arranged in such a way here that all of the increases (“+” signs) are on the outside and all of the decreases (“-” signs) are on the inside of this diagram. ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.