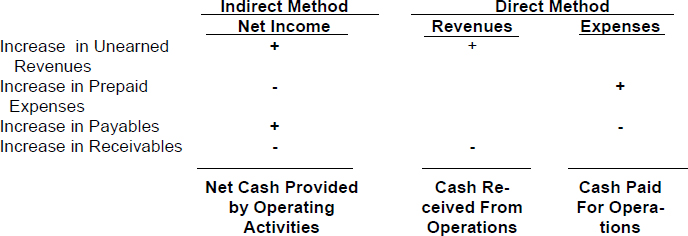

SUMMARY OF TREATMENT FOR ACCRUALS AND DEFERRALS

The treatment of increases during the period for unearned (deferred) revenues, prepaid (deferred) expenses, accrued expenses, and accrued revenues can be summarized for both the direct method and the indirect method as follows:

TIP: In examining the summary above, notice the mathematical signs are the same for both the direct method and indirect method for handling a change in unearned revenues or a change in receivables. The reasons for this are (1) changes in unearned revenues and receivables are items which explain the difference between revenues earned during a period and cash received from customers, and (2) revenues earned are a positive component of net income, and cash received from customers is a positive component of net cash provided by operating activities.

Also notice that the mathematical signs are different for the direct method and the indirect method for handling a change in prepaid expenses and payables. The reasons for this are (1) changes in prepaid expenses and payables are items which explain the difference between expenses incurred during a period and cash paid for operations, and (2) expenses incurred are a negative component of net income, and cash paid out for operations is a negative component of net cash provided by operating activities.

TIP: “Cash provided by operating activities” (or “cash provided by ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.