SOLUTION TO EXERCISE 13-3

Explanation:

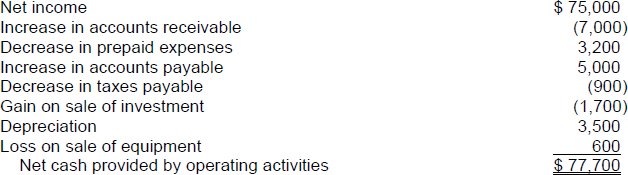

- Net income is a summary of all revenues earned, all expenses incurred, and all gains and losses recognized for a period. Most revenues earned during the year result in a cash inflow during the same period but there may be some cash and/or revenue flows that do not correspond. Most expenses incurred during the year result in a cash outflow during the same period but there may be some cash and/or expense flows that do not correspond.

- An increase in accounts receivable indicates that revenues earned exceed cash collected from customers and, therefore, net income exceeds net cash provided by operating activities.

- A decrease in prepaid expenses indicates that expenses incurred exceed cash paid and, therefore, net income is less than net cash provided by operating activities.

- An increase in accounts payable indicates that expenses incurred exceed cash paid and, therefore, net income is less than net cash provided by operating activities.

- A decrease in taxes payable indicates expenses incurred are less than the cash paid, and, therefore, net income is greater than net cash provided by operating activities.

- When an investment is sold, the entire proceeds are to be displayed as an investing activity on the statement of cash flows. The gain included in net income must, therefore, be deducted from net income to arrive at the net cash provided by operating ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.