SOLUTION TO EXERCISE 12-4

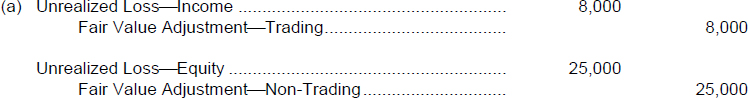

Explanation: Investments in marketable equity securities are to be accounted for by the equity method if the investor has significant influence over the investee. When the equity method is inappropriate, the securities are accounted for by the cost method and are reported at fair value. With this latter method, the securities are first grouped into one of two portfolios: the trading portfolio or the non-trading portfolio. Each portfolio is to be reported at fair value. Thus, the total market value of the trading portfolio at the balance sheet date ($222,000) is compared with the total cost of the trading portfolio ($230,000) to determine the balance needed in the related valuation (fair value adjustment) account. If market value is lower than cost, a credit balance is needed in the valuation account for the excess of cost over market ($8,000 in this case). Thus, the fair value adjustment account is credited and an unrealized loss account is debited. The same comparison is made for the non-trading portfolio. The journal entry to establish a valuation account for the nontrading portfolio looks very similar to the journal entry to establish a valuation account for the trading portfolio but a major difference lies in the reporting of the unrealized loss (or gain) account [see part (b) of this exercise]

Explanation: Changes in the valuation account for the ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.