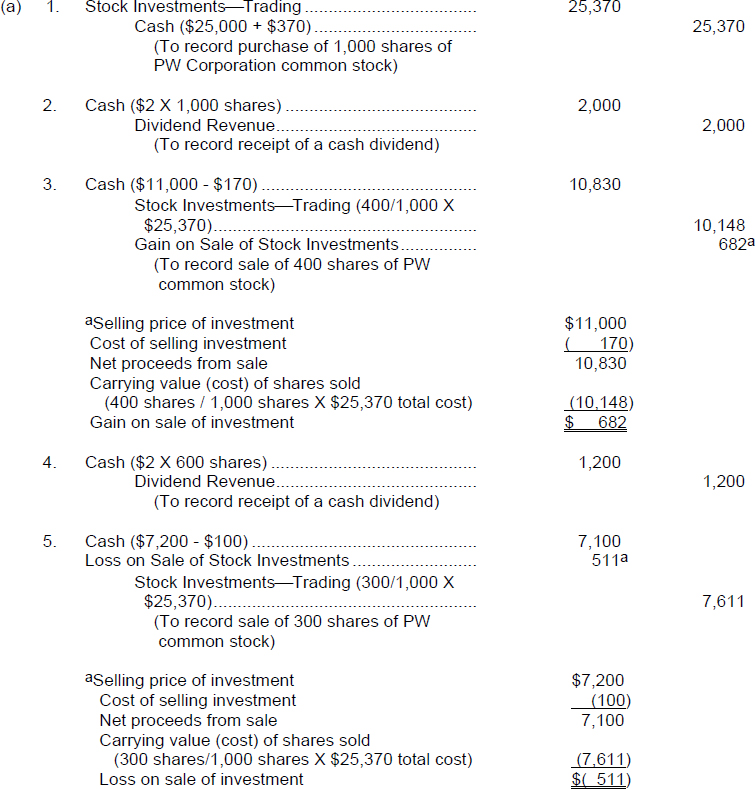

SOLUTION TO EXERCISE 12-3

TIP: When more than one investment is sold during the period, the resulting realized gains and losses are usually netted on the income statement; thus, the gain of $682 and the loss of $511 above would net to a gain of $171 for reporting purposes.

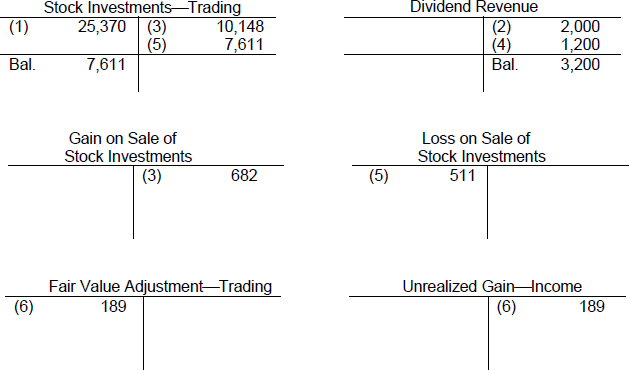

Approach and Explanation: Draw T-accounts, post the journal entries and balance the relevant accounts as follows:

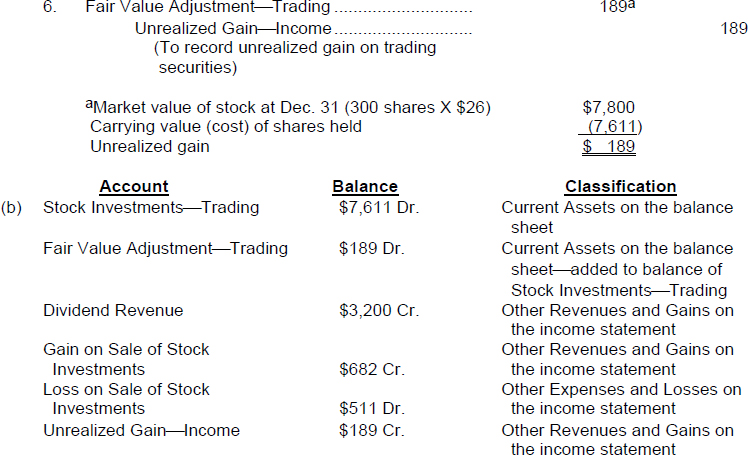

TIP: The facts for Exercise 12-3 are the same as the facts for Exercise 12-2 except for the fact that the stock is classified as trading securities in Exercise 12-3 rather than as non-trading securities as in Exercise 12-2. Compare the Solution to Exercise 12-3 with the Solution to Exercise 12-2 and notice that although both situations report the investment at fair value on the balance sheet, the changes in fair value while the security is held (unrealized holding gains and losses) for the trading portfolio go through the income statement (and therefore affect retained earnings) whereas the changes in fair value for the non-trading portfolio bypass the income statement and go straight to a separate component of stockholders' equity. Thus, both situations have the same net impact on stockholders' equity ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.