SOLUTION TO EXERCISE 11-10

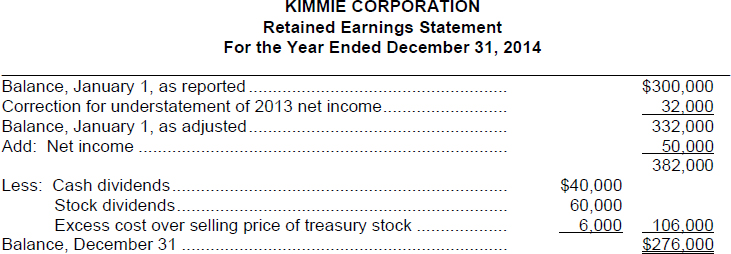

TIP: The retained earnings statement is a required general purpose financial statement. It is frequently called the statement of retained earnings. Its purpose is to explain all of the reasons why the balance of the Retained Earnings account changed during the reporting period. Transactions and events that affect retained earnings are tabulated in account form as follows:

Retained Earnings

| 1. Net loss | 1. Net income |

| 2. Prior period adjustments for overstatement of net income | 2. Prior period adjustments for understatement of net income |

| 3. Cash dividends and stock dividends | |

| 4. Some disposals of treasury stock |

As indicated, net income increases retained earnings and a net loss decreases retained earnings. Prior period adjustments may either increase or decrease retained earnings, whereas both cash and stock dividends decrease retained earnings. Some treasury stock transactions decrease retained earnings. One of those situations involves the sale of treasury stock for a price below cost when the cost method of accounting is used for treasury stock transactions and no balance exists in a Paid-in Capital from Treasury Stock account.

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.