EXERCISE 11-6

Purpose: (L.O. 3) This exercise will illustrate the use of the cost method of accounting for treasury stock transactions under a variety of price relationships.

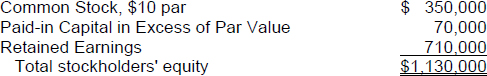

Cheers Corporation reported the following stockholders' equity items at December 31, 2013. Each share of stock was issued in a prior year for $12 each.

During 2014, Cheers had the following treasury stock transactions:

- Purchased 1,000 shares at $15 per share.

- Purchased 1,000 shares at $13 per share.

- Sold 1,000 treasury shares at $11 per share.

- Sold 1,000 treasury shares at $14 per share.

- Purchased and retired 1,000 shares at $16 per share.

Instructions

Prepare the journal entries for the treasury stock transactions listed above. Apply a FIFO (first-in, first-out) approach in determining the cost of treasury shares sold.

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.