SOLUTION TO EXERCISE 11-4

Explanation:

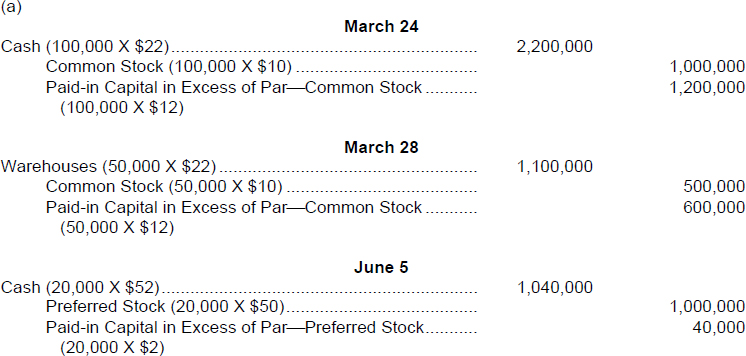

| March 24 | The issuance of stock in exchange for cash is recorded by crediting stockholder equity accounts for the amount of the cash consideration received ($2,200,000). The par value ($10) per share is put into the related capital stock account, and the excess of the issuance price over par per share ($12) is recorded in the related additional paid-in capital account. When more than one class of stock is authorized, any additional paid-in capital amounts are properly identified to indicate the related class of stock. |

| March 28 | The issuance of stock in exchange for noncash assets requires an application of the cost principle. The asset and the stock are to be recorded at the fair market value of the consideration given (the stock) or the fair market value of the consideration received (warehouses), whichever is the more clearly determinable. Because some shares of common were issued only four days earlier at $22 per share, the March 24 transaction provides good evidence of the fair value (cash equivalent value) of the stock issued on March 28. |

| June 5 | In recording the issuance of preferred shares for cash, the par value of the preferred shares issued is placed in a capital stock account for that class of stock. The amount received in excess of par is an element of additional paid-in capital; the account title clearly indicates the related ... |

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.