*EXERCISE 10-13

| Purpose: | (L.O. 5, 11) This exercise will illustrate the computations and journal entries made throughout a bond's life when the straight-line method of amortization is used. |

Arnie Howell Corporation issued bonds with the following details:

| Face value | $100,000.00 |

| Contractual interest rate | 7% |

| Market interest rate | 10% |

| Maturity date | January 1, 2017 |

| Date of issuance | January 1, 2014 |

| Issuance price | $92,539.95 |

| Interest payments due | Annually on January 1 |

| Method of amortization | Straight-line |

| End of annual reporting period | December 31 |

Instructions

- Compute the amount of issuance premium or discount.

- Prepare the journal entry for the issuance of the bonds.

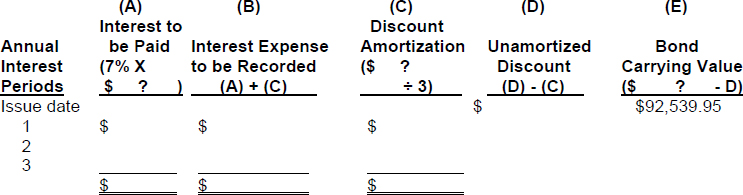

- Complete the amortization schedule (for these bonds) which appears below. Also supply the missing amount in the heading for columns (A), (C), and (E).

- Prepare all of the journal entries (subsequent to the issuance date) for 2014, 2015, and 2016. (Assume reversing entries are not used.)

- Prepare the journal entry to record the payment of the face value at the maturity date. Also prepare the journal entry to record the final interest payment due on January 1, 2017.

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.