SOLUTION TO EXERCISE 10-9

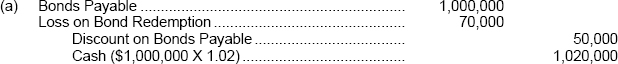

Approach and Explanation: (1) Always begin with the easiest part of the journal entry. Credit Cash to record the payment of the redemption price which is 102% of the face value of the bonds. (2) Remove the carrying value of the bonds from the accounts by debiting Bonds Payable for the face value of the bonds and crediting Discount on Bonds Payable for the balance of the related unamortized discount. The difference between the redemption (retirement) price and the carrying value of the bonds represents a gain or loss on redemption. An excess of redemption price over carrying value results in a loss; an excess of carrying value over redemption price results in a gain. In the case at hand, the redemption price ($1,020,000) exceeds the carrying value of the bonds ($950,000). When it costs $1,020,000 to eliminate a debt that appears on the books at only $950,000, a loss results.

TIP: Gains or losses on extinguishment of debt are classified as other revenue or gain or other expense or loss on the income statement.

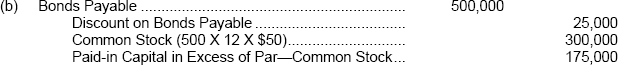

Approach and Explanation: The carrying value of the bonds being converted ($500,000 face value less the related unamortized bond discount of $25,000 equals the carrying value of $475,000) is transferred to paid-in capital accounts, and no gain or ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.