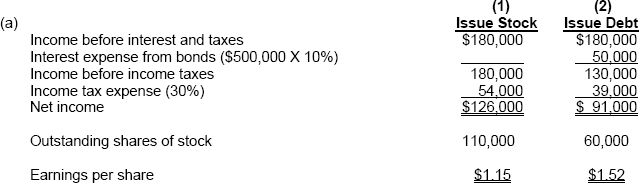

SOLUTION TO EXERCISE 10-5

TIP: This analysis shows that if the company issues debt securities and can operate at the estimated income level, it will be using leverage successfully (that is, favorable trading on the equity).

TIP: Notice the difference between the two net income figures ($126,000 - $91,000) is the net-of-tax interest amount (70% × $50,000 = $35,000).

- (b) From the standpoint of the corporation seeking long-term financing, bonds offer the following advantages over common stock:

- Stockholder control is not affected. Bondholders do not have voting rights, so current stockholders retain full control of the company.

- Tax savings result. Bond interest is deductible for tax purposes; dividends on stock are not. For example, if a bond pays 10% interest and the corporation is in the 30% tax bracket, the net cash cost to the corporation is only 7%. If a corporation pays a 10% cash dividend, the cash resources of the company are reduced by the full 10%.

- Earnings per share of common stock may be higher. Although bond interest expense will reduce net income, earnings per share of common stock will often be higher under bond financing because no additional shares of common stock are issued.

![]()

ILLUSTRATION 10-1 FORMATS FOR COMMON COMPUTATIONS INVOLVING BONDS PAYABLE (L.O. 5, 6, ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.