SOLUTION TO EXERCISE G-2

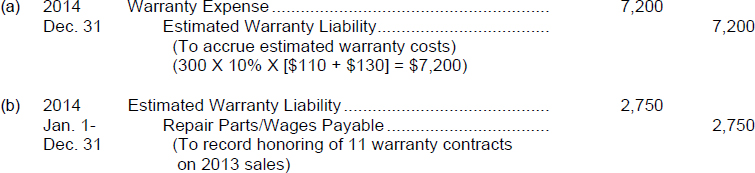

TIP: The entry in part (b) is shown in summary form. Throughout the year, customers will bring in units for warranty service and an entry to record the performance of the warranty work will be recorded at that time. The entry in part (a) is made only once a period, in the adjusting process at the end of the period, so the entry(s) in (b) is actually recorded chronologically before the entry illustrated in (a).

(c) Warranty expense of $7,200 is reported in the selling expense classification (which is part of operating expenses) in the income statement for the year ending December 31, 2014. The balance of $4,450 ($7,200 - $2,750) in the Estimated Warranty Liability account is to be classified as a current liability on the balance sheet at December 31, 2014.

(d) The accounting for warranty costs is based on the matching principle. To comply with this principle, the estimated cost of honoring product warranty contracts should be recognized as an expense in the period in which the sale occurs.

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.