SOLUTION TO EXERCISE F-7

TIP: The cash payments journal is often called the cash disbursements journal.

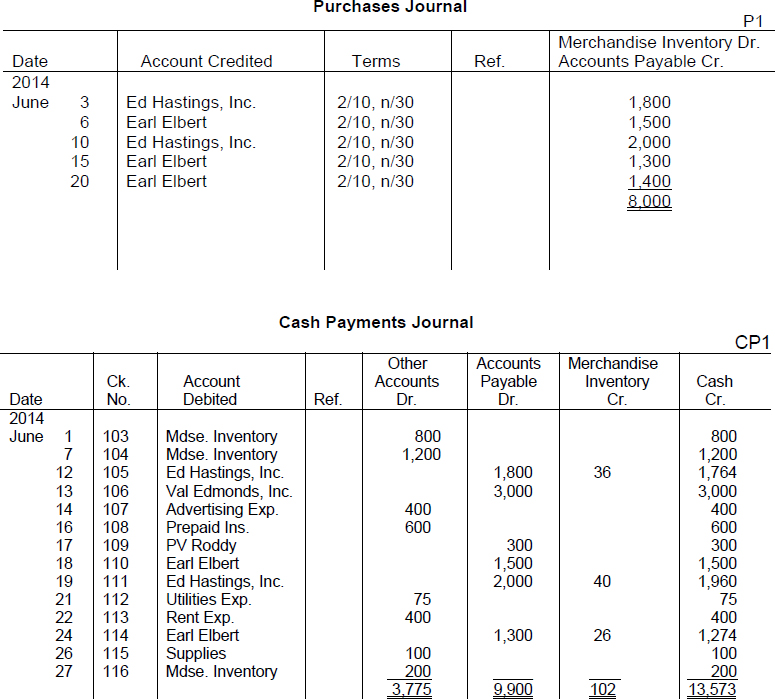

TIP: Some companies expand the purchases journal to include all types of purchases on account. Instead of one column for purchases of merchandise on credit (requiring postings to both Merchandise Inventory and Accounts Payable), a multiple-column format is used. The multiple-column format usually includes a credit column for accounts payable and debit columns for purchases of merchandise, purchases of office supplies, purchases of store supplies, and other accounts. A special column can be added for purchases of equipment if the activity warrants it.

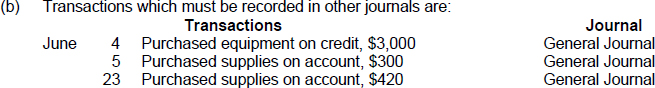

TIP: The general journal is used to record transactions that do not occur with enough frequency to warrant the creation of a special journal.

(c) Footing is accomplished by adding the amounts of each column and inserting the totals at the bottom of the respective columns. There is nothing to cross-foot in a single-column journal because there is only one column. The cash payments journal is cross-footed by summing the totals of the debit columns ($3,775 +$9,900 = $13,675) and comparing that sum with the sum of the totals of the credit columns ($102 + $13,573 = $13,675). The two sums are equal so the journal cross-foots. This means ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.