SOLUTION TO EXERCISE F-6

(a)

PW COMPANY

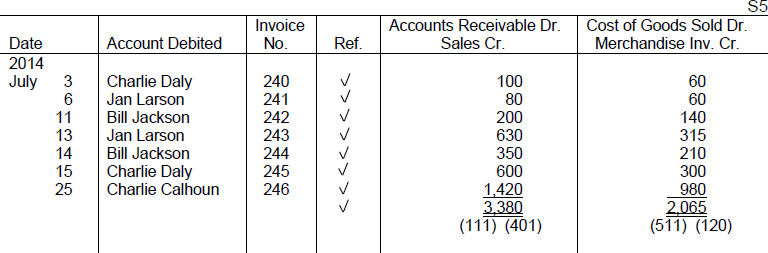

Sales Journal

TIP: Practically all states and cities require a sales tax be charged on items sold, which the company must remit to the state or city. In this case, it is desirable to add an additional credit column to the sales journal for Sales Tax Payable. Sales Tax Payable is posted in total at the end of the month, similar to sales. Accounting for sales taxes is not illustrated in this exercise.

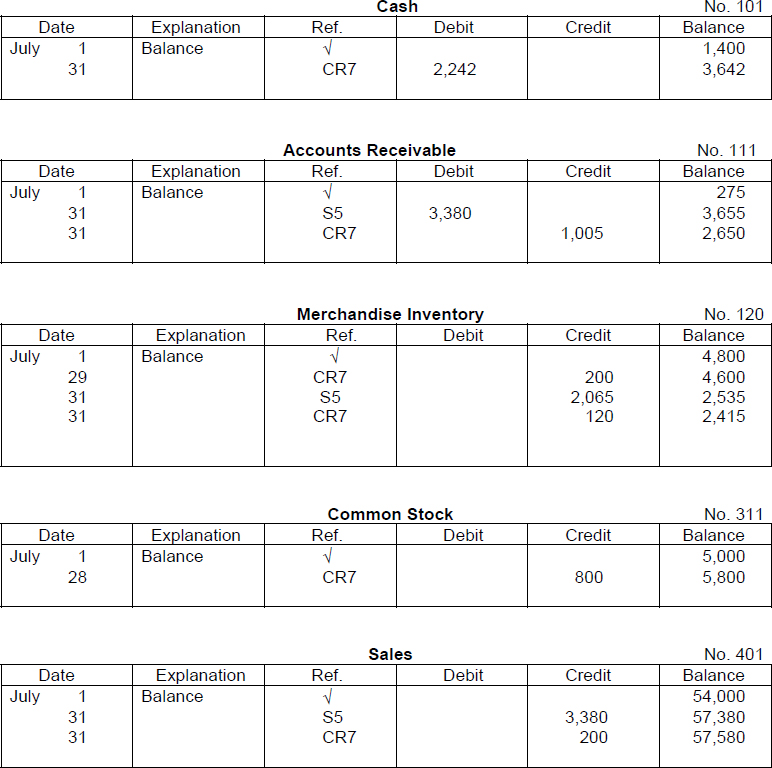

PW COMPANY

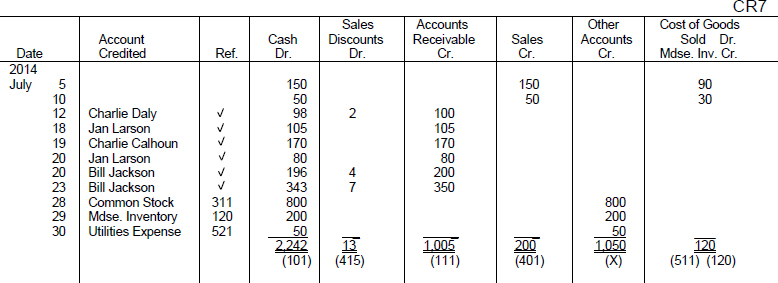

Cash Receipts Journal

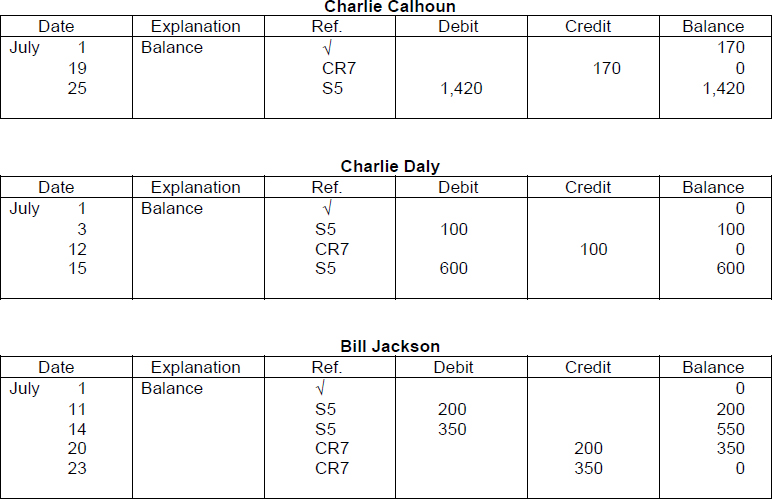

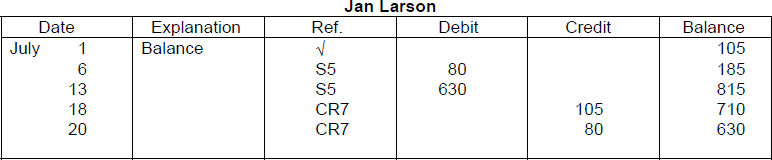

ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER

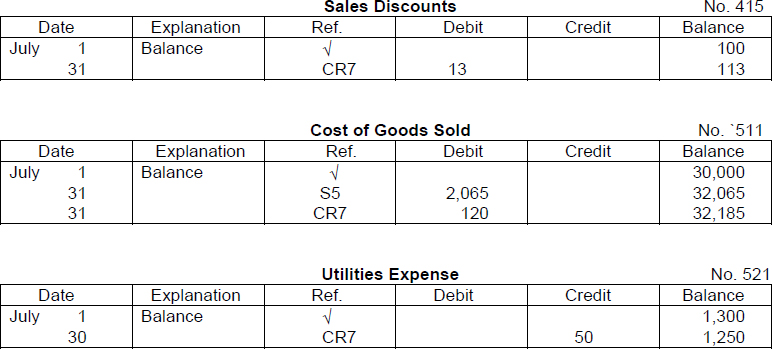

GENERAL LEDGER

TIP: The accounts listed above all have a single balance column. Therefore, the balance is assumed to be a normal balance for that type of account (debit versus credit) unless the balance is in brackets ( ) or is circled or is printed in red ink, in which case the balance is an abnormal one.

TIP: Total debits do not equal total credits in the general ledger accounts ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.