SOLUTION TO EXERCISE E-1

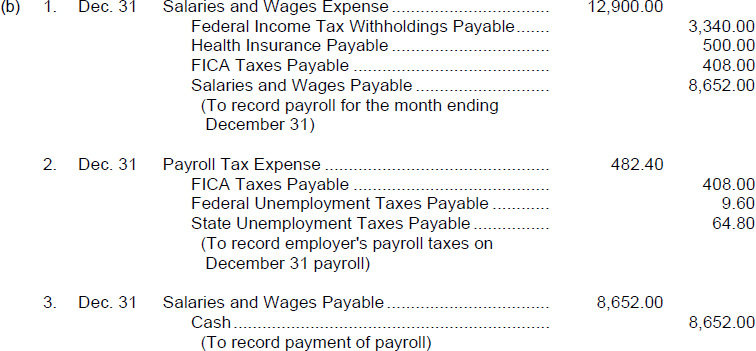

(c) At December 31, 2014, the balances in Federal Income Tax Withholdings Payable, Health Insurance Payable, FICA Taxes Payable, Federal Unemployment Taxes Payable, and Statement Unemployment Taxes Payable will be classified in the current liability section of the balance sheet because they are all obligations that become due shortly after the balance sheet date and will require the use of current assets to liquidate them.

Explanation:

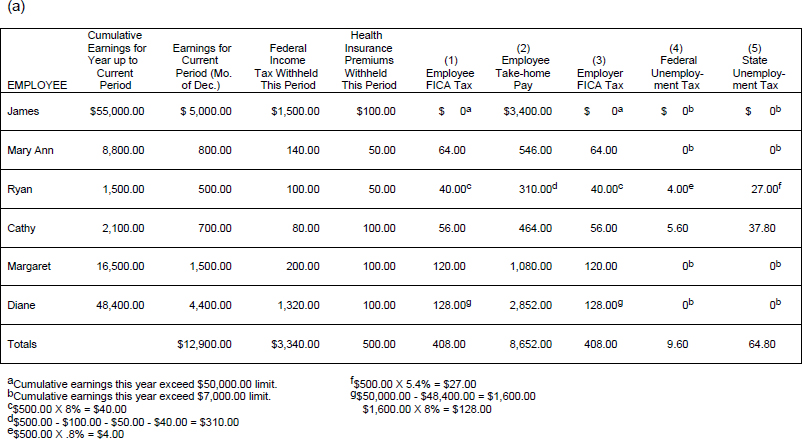

- An amount equal to 8% of an employee's gross earnings is withheld from the employee's paycheck and is remitted to the federal government for FICA taxes. This represents the employee's share of the FICA tax.

- An employee's net pay (or take-home pay) is calculated by the following:

Employee's gross earnings for the current period

- Federal income tax withholdings

- FICA tax withholdings

- Withholdings for voluntary deductions such as for charitable contributions, group health and life insurance premiums, savings, retirement fund contributions, and loan repayments

= Net (or take-home) pay

- The employer must also bear a portion of the FICA tax. The FICA tax applies on earnings up to a certain level ($50,000 in this exercise). The employee James had surpassed this level prior to December so no FICA taxes are due on him for December. ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.