8.4 SUMMARY

In this chapter, we looked at the user interface part of the companion program, the pricing tool. Among its significant strong points are the clean separation between the GUI elements and the mathematical finance libraries, and self-adapting interfaces. In fact, a fully functional, compiled version of the pricing tool contains no mathematical finance intelligence other than some day-count conventions and the notion of the finite difference Greeks (which may be considered too generic to be called ‘quant’ intelligence). Thanks to this rigorous fire-walling, the pricing tool is able to generate a code template for model implementation and adapts its interfaces and behaviour to any valid product–model combinations, and can ‘render’ and manipulate them. One can see the similarity between the pricing tool and any document-handling programs (such as a word processor, HTML renderer, image editor, etc.) that are generic and agnostic to the semantics of the document under consideration. They can work with the document through its syntactical validity.

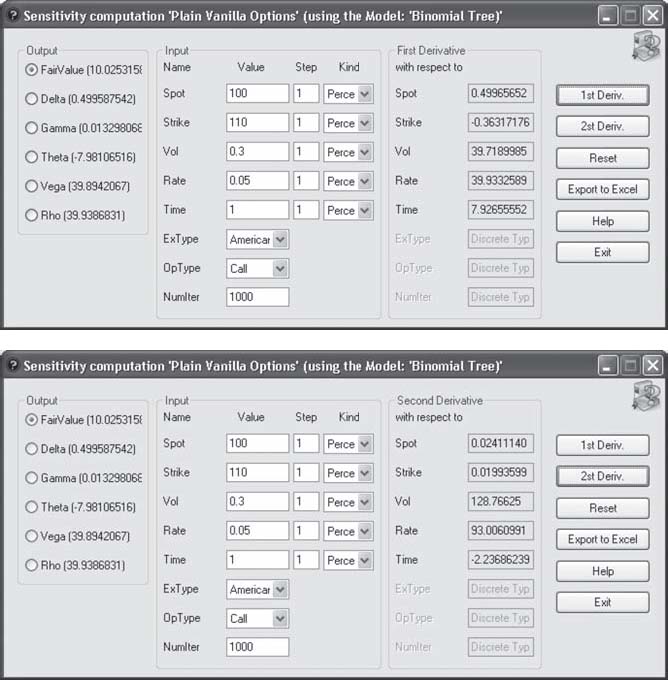

Figure 8.14 Computing finite difference sensitivities of an American call option using the binomial tree pricing model in the pricing tool. The top figure shows the results for first-order derivatives, while the bottom one shows the second order. Note that the input and outputs of types for which the derivatives do not make sense ...

Get Principles of Quantitative Development now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.