3.3 VALIDATION

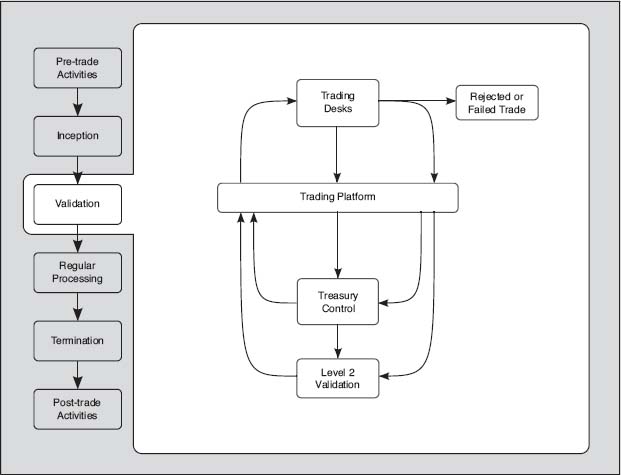

After it is booked, the trade moves to the treasury control team of the middle office to get validated (see Figure 3.3). Their job is to ensure that the trade accurately reflects the specifications in its term sheet and contract. They verify the trade details, validate the initial pricing, apply some reasonable reserves against the potentially inflated profit claims of the front office and come up with a simple ‘yes’ or ‘no’ response to the trade as it is booked. The reply from the MO, in fact, is something like an ‘ACK’ (trade is valid and acknowledged) or a ‘NACK’ (not valid). Depending on how careful the traders (or their assistants) are, a large proportion of the trades may get NACKed and bounced back to the trading desk. The desk then will correct the errors and re-book.

Figure 3.3 Trade validation in the middle-office treasury control team is a complicated process with multilevel approval processes and full audit trails

Once the trade passes the validation, a trade confirmation is sent to the counterparty. Note that even in the absence of validation, the trade is still ‘live’ and has to be risk-managed.

Big Picture 3.2: Workflow Engine

The processes around inception, approval and event management are sufficiently complex and interrelated that a specialized workflow engine may be called for. Such workflow engine solutions (also know as Business Process Management ...

Get Principles of Quantitative Development now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.