311

20

Experience Rating for Non-Proportional Reinsurance

The objective of this section is to show how we can adapt the risk-costing process that we

developed in the previous chapters for the purpose of pricing non-proportional reinsur-

ance. Note that proportional reinsurance, because it just cedes a proportional amount of

each risk to the reinsurer, will not be signicantly different from direct insurance and

therefore does not require a separate treatment.

Non-proportional reinsurance pricing has some peculiarities we need to cater to. For

example,

i. The policy basis may be ‘losses occurring during’ (LOD; not different from

the standard occurrence policy of direct insurance), ‘claims made’ (as in direct

insurance) and ‘risk attaching during’ (RAD; which has no equivalent in direct

insurance)

ii. Only losses above a certain agreed threshold, called the reporting threshold (e.g.

£500,000) will be reported to the reinsurer for the reinsurer to price layers well

above that threshold (e.g. £3M xs £2M). This is sometimes also true for commercial

insurance, but the threshold is much lower and less of a concern for the analysis

iii. Specic exposure alignments and adjustments are needed to take into account the

difference between ‘written premium’ and ‘earned premium’ and also to take into

account rate changes of the original direct policy

iv. It is more common in reinsurance to receive information on the historical develop-

ment of each claim

v. The presence of the indexation clause leads to the need to consider the settlement

pattern (London Market clause) and the payment pattern (continental clause) to

estimate the effect of the changes in layer denition

vi. The presence of long payment delays for large liability losses also leads to the need

to consider the payment pattern to set premiums that take investment income into

account (as is also the case for direct insurance but to a lesser degree)

Let us look at each of these peculiarities in the context of the risk-costing process, and

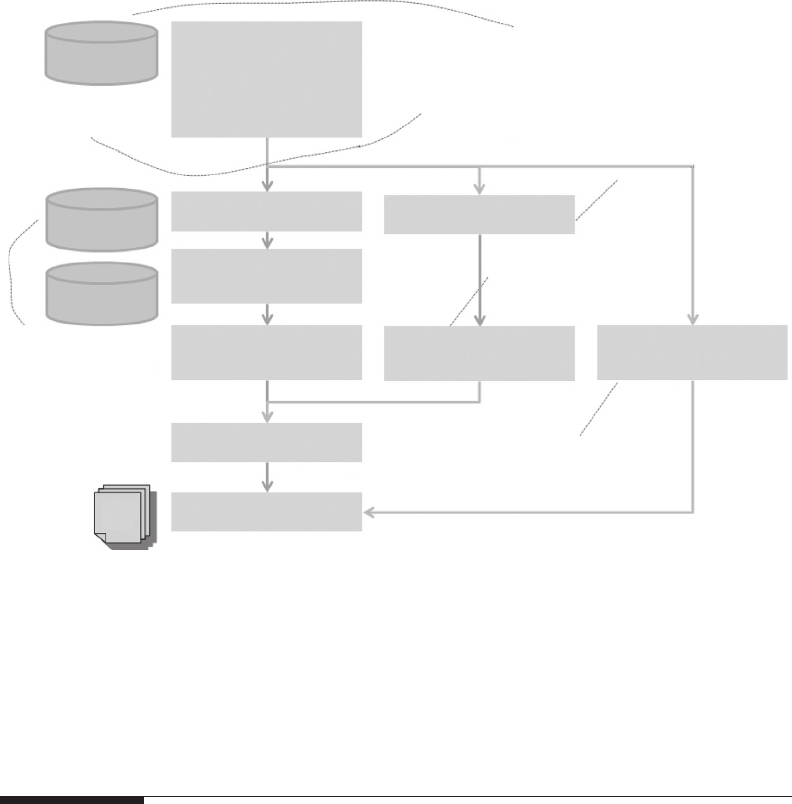

see how they lead to redening the risk-costing process as in Figure 20.1.

312 Pricing in General Insurance

20.1 Types of Contract

As we have seen in Section 3.3, there are several types of contract in reinsurance, depend-

ing on which losses are covered by the policy. As a reminder, the most widely used types

of contract are

• LOD, which covers all losses occurring during the specied period, regardless of

the original policy’s inception date and of the loss reporting date

• RAD, which covers all losses attaching to policies that have incepted during a

specied period, regardless of occurrence and reporting date

• ‘Claims made’, which covers all losses reported to the reinsured during the reinsur-

ance policy period, regardless of the original policy’s inception date and the loss

occurrence date

Only individual losses above an agreed reporting

threshold are normally provided.

Loss inflation is normally higher than for ground-up losses.

e historical development of all claims is

often part of the reinsurance submission

for certain classes of risk (e.g. liability).

A threshold distiribution such as a

Pareto, and exponential or a generalised

Pareto distribution is normally used.

If an index clause is in place,

losses to a layer of reinsurance

depend on the timing of payment or

settlement as well as on the loss amount.

Ex

posure must be on an

earned, wri

tten or

re

porting basis depending

on whether the p

olicy is

LOD

, RAD or claims made.

Orig

inal premium is often

used as e

xposure and

ne

eds to be on-levelled

based on pr

emium rate

change.

Assumptions on

– Loss inflation

– Currency conversion

Individual

loss data

Exposure

data

Portfolio/market

information

Inputs to frequency/severity analysis

Frequency model

Gross aggregate loss model

Ceded/retained

aggregate loss model

Severity model

Payment/settlement model

Cover

data

Data preparation

Adjust historical claim

counts for IBNR

Adjust for

exposure/profile

changes

Select frequency

distribution and

calibrate parameters

Select severity

distribution and

calibrate parameters

Select and calibrate

payment/settlement

distribution

Adjust loss amounts for

IBNER

– Data checking and cleansing

– Data transformation

– Revaluation and currency

conversion

– Data summarisation

– Simple statistics

Estimate gross

aggregate distribution

Allocate losses between

reinsurer and reinsured

Reinsurance Experience Rating – How It Differs from the Standard Risk-Costing Process

FIGURE 20.1

The revised risk-costing (sub)process for reinsurance pricing. The main difference with the process of Figure 6.1

is the presence of a third branch for the creation of a payment/settlement pattern model, which is used to deal

with the index clause when this features in the reinsurance contract (as is normally the case in treaty reinsur-

ance for liability classes). However, the process needs to be tweaked almost everywhere to accommodate the

idiosyncrasies of reinsurance pricing.

Get Pricing in General Insurance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.