167

13

Frequency Modelling: Adjusting

for Claim Count IBNR

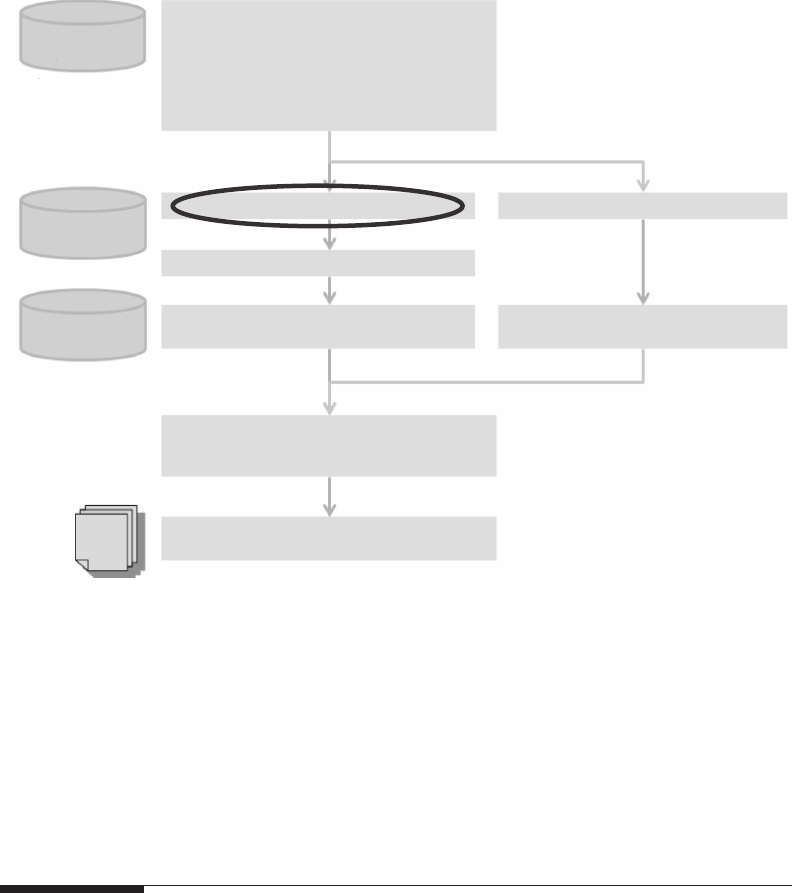

We now get into the heart of the frequency/severity model. We rst turn our attention to

frequency modelling. Because producing a frequency model means calculating the char-

acteristics of the frequency distribution such as its mean and its variance, we need to know

the ultimate claim count for each year. However, the only information we have is the num-

ber of claims reported in any particular year. To go from the reported claim count to the

ultimate claim count, we need to estimate the number of incurred but not (yet) reported

(IBNR) claims. The objective of this section is to illustrate how this can be done. Figure 13.1

shows how IBNR adjustment ts in the risk costing process – this will help us not to lose

track of the overall scheme of things.

13.1 Input to IBNR Adjustment

The data required for the IBNR adjustment are roughly the same as those described for the

pricing exercise as a whole, and are spelled out in Chapter 8, except for the information on

the exact claim amounts. To recap, we need individual claims information, and for each

claim, we need at least:

• The loss occurrence date.

• The reporting date.

• The quantication date (the date at which a non-zero incurred amount was rst

attached to a claim).

• The date at which the claim was set back to zero (if applicable) because at that point the

loss will disappear from the count of non-zero losses. This replaces the require-

ment of the individual transition dates for every claim transition, that is, all times

at which the outstanding loss amount was revised.

In practice, we may not always be able to have all the information above. Frequently, if

we have individual-claim information, we may only have a snapshot of the claims infor-

mation at a point in time, and only the most basic dates (loss date and reporting date) may

be available, as in Figure 13.2: in this case, we may need to make some assumptions on the

quantication date and on the issue of claims going back to zero.

Alternatively, we may be given claim count triangulations such as that in Figure 13.3, in

which the number of non-zero claims at different points in time is predigested for us. This

is summarised information and therefore not as complete as individual-claim informa-

tion, but at least it takes into account the issue of non-zero claims automatically.

168 Pricing in General Insurance

It sometimes happens that we simply do not have enough information to make a judg-

ment on the delays; for example, because we are missing the loss date or the reporting date.

In these cases, we will need to use external information to assess IBNR levels.

In the rest of this chapter, we will make use of the case study introduced in Chapter 11,

and for which the data set is also available on the book’s website.

13.2 Triangle Development Methods for IBNR Estimation

The most common method for the estimation of the number of IBNR claims is based on

the development of claims count triangles, using the chain ladder or other similar triangle

development techniques for projecting the claim count to ultimate.

The main assumptions in doing this projection are that

a. All years develop in roughly the same way (so that we can apply past development

factors to the years currently not complete).

b. There is no further development for the earliest year (so that we do not have to

worry about developments after a certain number of years).

Individual

loss data

Assumptions on

– Loss inflation

–

Currency conversion

– …

Exposure

data

Portfolio/market

information

Data preparation

– Data checking

– Data cleansing

– Data transformation

– Claims revaluation and currency conversion

– Data summarisation

– Calculation of simple statistics

Inputs to frequency/severity analysis

Adjust historical claim counts for IBNR

Adjust for exposure/profile changes

Select severity distribution and

calibrate parameters

Select frequency distribution and

calibrate parameters

Adjust loss amounts for IBNER

Severity mode

l

Frequency model

Estimate gross aggregate distribution

e.g. Monte Carlo simulation, Fast Fourier

transform, Panjer recursion…

Gross aggregate loss model

Ceded/retained aggregate loss model

Allocate losses between (re)insurer and

(re)insured

Cover

data

FIGURE 13.1

This is how adjusting for the number of IBNR claims ts in the overall risk costing process. Specically, it is part

of frequency analysis, which eventually leads to a frequency model.

Get Pricing in General Insurance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.