123

10

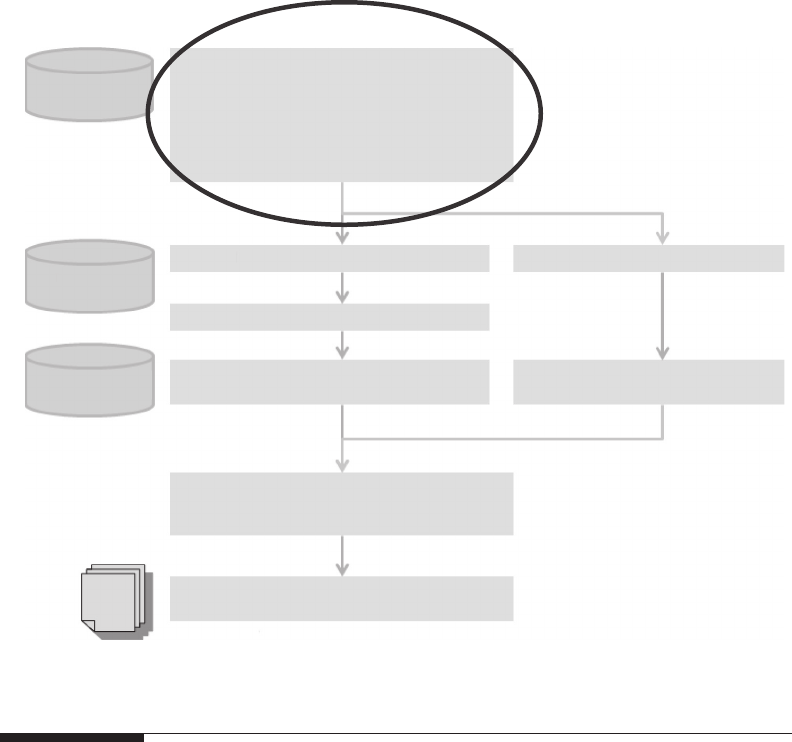

Data Preparation

Modelling is rarely an automated process by which one transforms a raw set of data into a

set of results. Before any modelling can be attempted, a signicant amount of exploratory

work often needs to be carried out on the raw data. For lack of a standard term, we call this

exploratory work ‘data preparation’ (Figure 10.1). This is often an open-ended exercise but

will normally involve the following activities:

• Checking data to determine whether there are errors or anomalies

• Summarising data to provide a bird’s-eye view of the risk and understand obvious

trends/anomalies

• Preparing a standardised input for the rest of the risk costing process, in particu-

lar for the frequency and the severity analysis

To keep things as concrete as possible, let us illustrate data preparation using a real-

world data set, in which amounts and names have been disguised beyond recognition for

data privacy purposes. The policyholder (or prospective policyholder) discussed here is in

facilities management, and the policy is public liability.

An excerpt from the data can be seen in Figure 10.2. The complete version of the data

set (with more columns and many more rows) contains 1718 claims, some of which are

claims with zero amounts. In the following, we will keep this example in mind to illustrate

the various steps of data preparation. We assume that we need to price an annual public

liability policy that incepts on 1 April 2015. We assume claims ination to be 5% (a com-

mon assumption for liability business). The claims data are given in pounds, but the policy

needs to be priced in euros. The exchange rate used here was 1£ = 1.2€.

A typical process will look something like a three-step approach involving data

cleansing (Section 10.1), data transformation (Section 10.2) and data summarisation

(Section 10.3).

10.1 Data Cleansing

Claims data are ‘cleansed’ and obvious mistakes are corrected. In a large company, this

may be done by teams that specialise in data cleansing and have systematic ways for

checking for anomalies such as data in the wrong format, gures that do not add up (e.g.

paid + outstanding not being equal to incurred) and so on. Anything dubious will be

referred back to the analyst. If some elds are missing, suitable assumptions must be made

about them.

124 Pricing in General Insurance

10.2 Data Transformation

Claims data are transformed so that they are ready to use in the rest of the risk costing

process. Some examples of data transformations, which should not be seen as exhaustive

in all cases, are illustrated in the following sections.

10.2.1 Claims Revaluation

The full incurred amount of all claims is revalued to bring them to the average point of

occurrence t* of the renewal policy by using the appropriate ination index I(t) as dis-

cussed in Chapter 9. More specically, this can be done by

a. Calculating the average point of occurrence t* of the renewal policy. This is nor-

mally the midpoint of the policy: e.g. for an annual policy incepting on 1 April 2015,

the midpoint will be 1 October 2015. However, if the claims exhibit seasonality (e.g.

if there are more claims during winter), then t* might be different from the mid-

point. In general, for a policy incepting at t = 0 and expiring at t = T,

tttdt

T

* =

∫

ν()

0

,

Individual

loss data

Assumptions on

– Loss inflation

–

Currency conversion

– …

Exposure

data

Portfolio/market

information

Adjust historical claim counts for IBNR

Adjust for exposure/profile changes

Select severity distribution and

calibrate parameters

Select frequency distribution and

calibrate parameters

Adjust loss amounts for IBNER

Severity mode

l

Frequency model

Estimate gross aggregate distribution

e.g. Monte Carlo simulation, Fast Fourier

transform, Panjer recursion…

Gross aggregate loss model

Ceded/retained aggregate loss model

Allocate losses between (re)insure and

(re)insured

Cover

data

Data preparation

– Data checking

– Data cleansing

– Data transformation

– Claims revaluation and currency conversion

– Data summarisation

– Calculation of simple statistics

Inputs to frequency/severity analysis

FIGURE 10.1

This is how exploratory analysis ts in the risk costing process.

Get Pricing in General Insurance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.