105

8

Data Requirements for Pricing

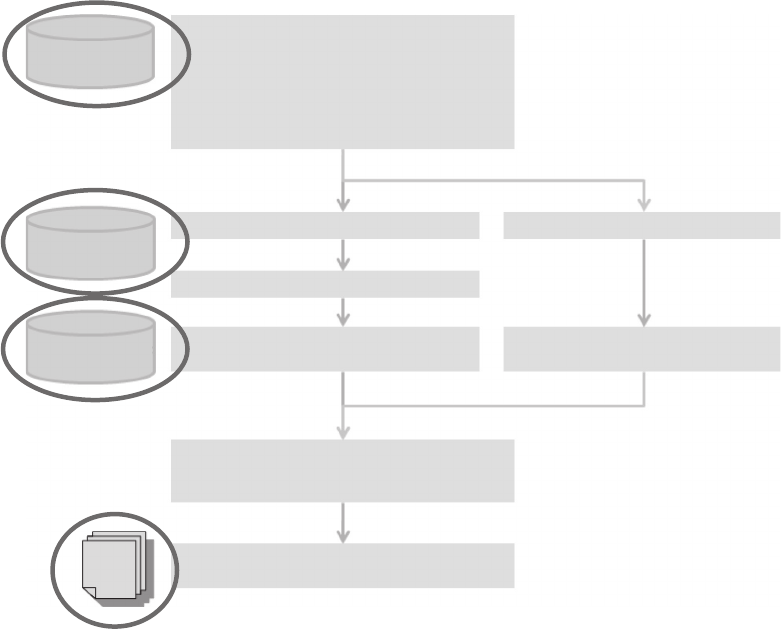

The actual analysis mostly starts with data, and you will need to have appropriate data to

undertake your risk costing exercise. As Figure 8.1 shows, there are several sources of data

that you will be interested in: some of it will be related to the client* (or prospective client),

and some will be external to the client (such as portfolio or market information).

One reason why it is important to understand what data you need for a pricing exercise

is that you often have to request this data explicitly and make sure it meets certain require-

ments. Alternatively, if you work for an underwriter, you may be in a position to help

dene how a claims/policies management system is to be structured.

8.1 Policies and Cover Data

To start with, we need to collect some basic information on the policies that we are sup-

posed to price. In the case of commercial lines, there may be a single policy, such as the

employers’ liability policy purchased by an organisation. In personal lines, pricing is car-

ried out on a portfolio of policies rather than on each policy in isolation. In reinsurance

treaties, we normally price a single reinsurance policy with an underlying portfolio of

policies underwritten by the reinsured.

Furthermore, policy data is paramount in other exercises apart from pricing, such as the

analysis of the performance of a portfolio.

Regardless of the number of policies we have in the portfolio, this is typically what you

should have for each policy:

• Policy ID

• Policy inception date

• Policy expiry date

• Policy limits and deductibles (individual and aggregate), both current and

historical

• Participation percentage (if the insurer does not underwrite 100% of the risk, but

coinsures the risk with others)

• Relevant exposure

• Rating factors (if applicable)

• Gross premium

• Brokerage fee

*

In practice, client-related data may be kept by the client itself (for example, by its risk management function),

or it might be in the hands of the insurers (both the current insurer and the ones from which the client has

purchased insurance in the past).

106 Pricing in General Insurance

• Type of coverage

• Territories

• Exclusions

In the case of reinsurance, we also need other information such as the policy basis

(claims made, losses occurring and risk attaching), the index clause, the hours clause and

the reinstatements. This will be addressed in more detail in Chapter 20 (Experience rating

for non-proportional reinsurance).

Figure 8.2 shows an example of policy data that has actually been used for the analy-

sis of the performance of a portfolio of nancial institutions policies (mostly professional

indemnity [PI], directors’ and ofcers’ liability [D&O], nancial institutions’ insurance [FI]).

Individual

loss data

Exposure

data

Portfolio/market

information

Adjust historical claim counts for IBNR

Adjust for exposure/profile changes

Select frequency distribution and

calibrate parameters

Adjust loss amounts for IBNER

Select severity distribution and

calibrate parameters

Severity model

Frequency model

Estimate gross aggregate distribution

e.g. Monte Carlo simulation, Fast Fourier

transform, Panjer recursion…

Ceded/retained aggregate loss model

Gross aggregate loss model

Allocate losses between (re)insurer and

(re)insured

Cover

data

Data preparation

– Data checking

– Data cleansing

– Data transformation

– Claims revaluation and currency conversion

– Data summarisation

– Calculation of simple statistics

Inputs to frequency/severity analysis

Assumptions on

– Loss inflation

–

Currency conversion

– …

e Risk Costing Process (Stochastic Modelling)

FIGURE 8.1

Data on different aspects of the risk (losses, exposure, cover and portfolio/market information) enters the pro-

cess at several points. Note that exposure data and portfolio information are used for several of the steps of the

process in frequency and severity modelling. For example, portfolio information can be used for tail model-

ling, frequency benchmarking and incurred-but-not-reported (IBNR) and incurred-but-not-enough-reserved

(IBNER) adjustment.

Get Pricing in General Insurance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.