EFFECTS OF DIFFERENT STOCK/BOND ALLOCATIONS

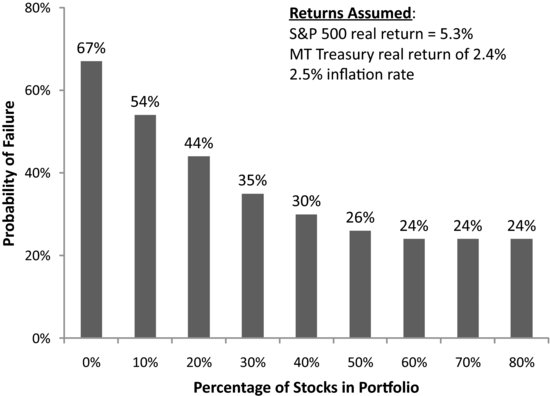

Low spending rules are required because of the risk of investment shortfalls. Is it possible to reduce the probability of failure by choosing a less risky portfolio? The answer to this question is counterintuitive. You would think that reducing the proportion of stocks in the portfolio from 75 percent to (say) 20 percent would reduce the risk of failure. In fact, it has the opposite effect.

To study the effects of different stock-bond allocations, consider a set of simulations based on the lower real stock return of 5.3 percent. The spending rate is set at the rate of 5 percent (that IRS rules require for many foundations). Figure 14.4 presents the failure rates for stock allocations ranging from 0 percent to 80 percent. Consider first the failure rate of 44 percent for a 20 percent stock allocation. The reason it is so much higher than that associated with a 75 percent stock allocation is that the 20 percent allocation has much too low an expected real return. The foundation is spending 5 percent even though most of its portfolio is invested in an asset with a 2.4 percent expected real return. The expected real return on bonds is simply too low to support such a spending rate.

FIGURE 14.4 Effects of Stock-Bond Allocation on Failure Rates

Figure 14.4 suggests that there is a tradeoff between the stock allocation and the spending rule ...

Get Portfolio Design: A Modern Approach to Asset Allocation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.