ALTERNATIVE ESTIMATES OF LONG-RUN STOCK RETURNS

Returns on equity are based on two components, the dividend yield and the capital gain on the stock price. Rising valuations might inflate the capital gain component, so average historical returns on stocks may give an inflated estimate of future returns. For that reason, some experts have proposed basing estimates of stock returns on corporate earnings or dividends rather than market returns.

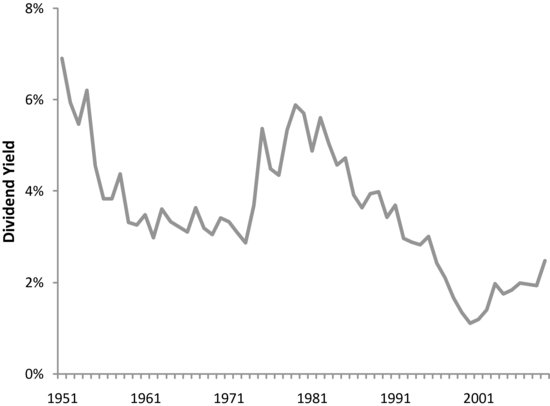

FIGURE 2.6 Dividend Yield for S&P 500, 1951–2009

Data Source: www.econ.yale.edu/∼Shiller and Bloomberg.

Fama and French’s (2002) study of the equity premium provides alternatives estimates of stock returns based on these corporate fundamentals. According to Fama and French, the average return on equity can be estimated in three alternative ways. The first measure simply calculates stock returns as we have already done using average dividend yields plus the average capital gains on the S&P 500 index. The second and third measures replace the capital gain on stocks with either the rate of growth of dividends or the rate of growth of earnings of the same firms in the S&P 500 index. (These measures are discussed at greater length in the appendix). The idea behind these measures is that capital gains cannot indefinitely outpace corporate fundamentals, so let’s base long-run estimates of stock returns on corporate fundamentals themselves.

Investors ...

Get Portfolio Design: A Modern Approach to Asset Allocation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.