Chapter 8

Strategic Asset Allocation

Mean-variance analysis has become so ingrained in investment management that it is difficult to conceive of a time when investments were guided by some other principles. Prior to the 1950s, investors naturally worried about risk at the same time that they strove to achieve returns. But there was little systematic thought about how the risk and return were related. It was Markowitz’s achievement to show that there was a natural tradeoff between risk and return, and that correlations among assets affected the risk of the overall portfolio.1

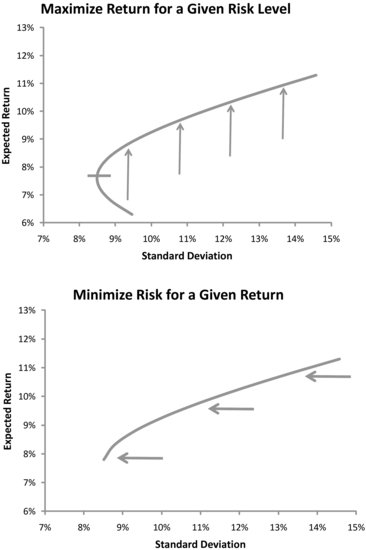

Figure 8.1 summarizes some of the insights provided by Markowitz’s work. Suppose that we consider a series of portfolios derived from a mixture of bonds and stocks. The portfolio with the lowest return on the left-hand chart consists of bonds alone. The portfolio with the highest return consists of stocks alone. All of the other portfolios are mixtures of the two assets. The risk itself is measured as the standard deviation of each portfolio.

FIGURE 8.1 Portfolios of U.S. Stocks and Bonds Illustrating the Markowitz Efficient Frontier

One noteworthy result is illustrated in the left-hand chart: the portfolio with the lowest risk asset, bonds, is dominated by other portfolios consisting of a mixture of stocks and bonds. That’s the case for portfolios consisting of U.S. bonds which are dominated by portfolios ...