The Big Decision—Asset Allocation

So the benchmark is, effectively, your long-term asset allocation decision, which is indeed the biggest driver of portfolio returns, long term. How big of an impact is debatable. An academic study by Gary Brinson, Randolph Hood and Gilbert Beebower posits 90% of your portfolio return is driven by asset allocation—the mix of stocks, bonds, cash or other securities.

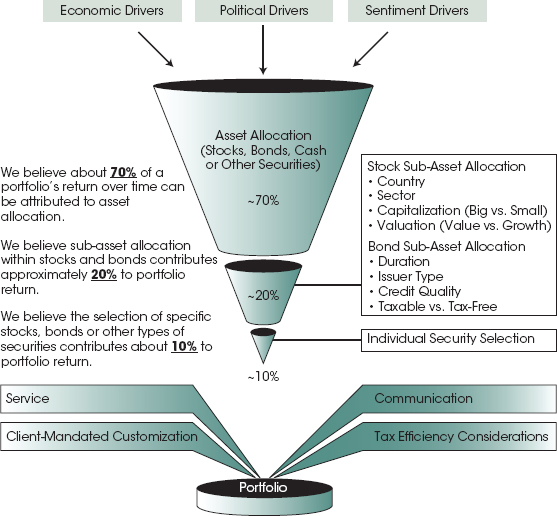

At my firm, we get a bit more granular. We believe about 70% of portfolio return is determined by the high-level stocks/bonds/cash/other securities decision and about 20% is driven by sub-asset allocation decisions—that is, what kinds of securities you are holding. (See Figure 3.1.) Are you holding more big-cap stocks or small? Growth or value? What is your weighting in the major sectors—Energy, Industrials, Materials, Financials, etc.? What about sub-industry selection? For bonds, are you holding Treasurys, munis or corporates? What credit rating? What duration? And so on.

Figure 3.1 The Asset Allocation Impact—70/20/10

Note: Forward-looking return attribution is an approximation intended for illustrative purposes and should not be considered a forecast of future returns or return attribution.

But most modern practitioners agree only a relatively small amount of performance over time is driven by the individual security decision—i.e., whether you hold Merck or Pfizer, Coke or Pepsi, ...

Get Plan Your Prosperity: The Only Retirement Guide You'll Ever Need, Starting Now--Whether You're 22, 52 or 82 now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.