Three Percent, Compounded

As mentioned, inflation’s long-term annual average is about 3%.7 Sometimes it’s been much higher (1970s and early 1980s), and sometimes much lower. Hard to know where it will go in the future, but a safe place to start for a projection is the long-term historical average, knowing you will go through spurts of higher and maybe lower levels in the future.

Three percent may not seem like much. But don’t forget the power of compounding! Long term, inflation can take a serious whack at your purchasing power.

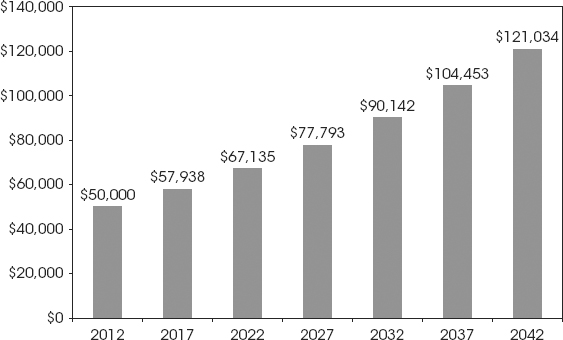

Say you’re 65 and retiring in 2012 and need about $50,000 a year to cover living expenses. If, over the long future ahead, inflation continues at that average rate, in 20 years when you’re 85, you’ll need over $90,000 to maintain your quality of life. In 30 years, you’ll need over $120,000. Figure 2.2 shows the insidious impact inflation has on purchasing power and how much more you need to just maintain the status quo.

Figure 2.2 Maintaining Purchasing Power

Source: Global Financial Data, Inc., as of 05/22/2012, CPI annualized rate of return from 12/31/1925 to 12/31/2011 was 3.0%.

Said another way, if you stashed $1 million under your mattress, in 30 years, that money would be worth around $400,000. You did nothing—you experienced no market-like volatility. Yet you still lost huge purchasing power!

Now, maybe your cost of living falls—you aren’t taking ...

Get Plan Your Prosperity: The Only Retirement Guide You'll Ever Need, Starting Now--Whether You're 22, 52 or 82 now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.