Introduction

Why should you pick up a book on personal investing? The answer is simple but stark: Because you have no choice. The sad truth is, you can’t save enough money in your lifetime to live comfortably in retirement (even with a Social Security check), send your kids to college, afford long-term health care, or take a dream vacation. Inflation is higher than savings account interest rates, and Social Security benefits go down while the age of eligibility goes up. To live comfortably in the future, you have to create a nest egg and grow it by investing.

Schools typically don’t teach personal finance, so unless your parents were savvy investors, you were probably unceremoniously dumped into the working world without much knowledge of financial planning or investing. To make matters worse, investing, like pumping gasoline, has evolved into a self-service industry, with 401(k)s replacing pensions, and discount brokerages standing in for full-service finance houses. If you don’t know how to plan and invest for your future, you won’t have a very rewarding one. So unless you were born wealthy or hit the Powerball lottery, you need to learn something about investing.

Don’t worry. As you’ll learn shortly, investing doesn’t have to be complicated. You can build a nest egg that meets your needs barely breaking a sweat. However, if you discover that you enjoy fiddling with investments, you can add plenty of tricks to your investment tool bag.

Why Investing Is Important

Coughing up the cash to buy a new Mr. Coffee—the one with the timer so your coffee is ready when you wake up—doesn’t require investing. Neither, for that matter, does a down payment on a Subaru Outback. For purchases like these, a few months or years of saving gets you the money you need.

Investing comes into play for stuff that costs a fortune—literally. Take retirement, for example. If you get a job right out of college, you might work for 45 years. During that time, your paychecks (not credit card debt!) cover your living expenses. At current life expectancies, if you retire at age 65, you’re looking at 35 to 40 years of retirement. Except that you won’t be getting a paycheck to cover your cost of living in your golden years. Living on Social Security (if it’s even still solvent when you retire) isn’t a pretty picture, and greeting customers at Walmart will lose its luster by the time you’re 80.

What can you do? At first blush, the answer seems to be to live on half your paycheck and save the other half for retirement. When you’re young, making ends meet on your salary is hard enough. Although your paychecks usually increase with time, so do your expenses. In the 1960s, a loaf of white bread cost 25 cents. Today, you eat whole wheat bread, and a loaf runs about $3. That’s what inflation does (see How Inflation Hurts for the full scoop).

With the average inflation rate at 3.4%, the cost of living doubles in about 21 years. By the time a college graduate reaches 100, annual living expenses would cost fourteen times as much, assuming she was still willing to live on pizza and use plastic milk crates as end tables. In addition, retirement isn’t the only big goal in your life. College education for your kids isn’t cheap, and it’s increasing even faster than inflation. You’ve seen how fast health costs and health care insurance premiums have gone up.

Savings accounts, certificates of deposit, and other savings options rarely beat inflation. Investing turns out to be the answer to this seemingly insurmountable challenge. By investing your money, you can earn 6% to 8% a year on average. That’s better than the thin film of mold you get burying your cash in the garden or the interest rates on savings accounts. Most importantly, investment returns are higher than inflation, so your nest egg stays ahead of the increase in prices. The same way inflation makes prices increase at an ever faster pace, investment returns help your money grow even faster. The process is called compounding, and Why Scary Numbers Aren’t That Scary explains how it works. Reinvesting your earnings like dividends and interest is another key to successful investing, as you learn on Face Your Fears: Understanding Investment Risks.

The First Step: Planning

Your next dilemma is figuring out how much you have to invest each month to reach your goals. On one hand, you want to save enough so you don’t have to compromise your goals down the road. On the other hand, you don’t want to over-save, because you sacrifice unnecessarily only to end up with money left over for your heirs or—heaven forbid—estate taxes.

You have some prep work to do before you start investing. Don’t sweat the pop quiz. You won’t be graded on your answers. Your assignment: Decide what your goals are. Sit down with a nice cup of tea, coffee, or something stronger, and make a list of what you want in life that costs money (Chapter 2). Be as decadent or as conservative as you want. You can change your mind later (although not decades later). Some goals appear on almost everyone’s list: retirement and college educations for your kids for starters. If you pass on procreation, you may opt for a sailboat, a greenhouse full of rare orchids, or climbing the tallest mountain on every continent. It’s totally up to you.

With wish list in hand, you don’t wait for a fairy godmother to sprinkle pixie dust to make it all come true. You have to come up with a plan to make it happen. How much are your goals going to cost? How much can you earn on your investments? And from there, how much do you have to invest regularly to amass that fortune? Chapter 2 guides you step by step.

Simple Steps to Successful Investing

If you could double your money every year, reaching your financial goals wouldn’t be an issue. However, the yin and yang of the financial world are risk and return. The more risk you’re willing to take, the higher the potential rewards you can get in investment returns.

With long-term goals like retirement 30 years from now, higher levels of risk aren’t unreasonable. The higher returns make it easier to reach your financial goals, and your investments have time to recover from short-term drops. Those short-term drops are where a lot of people get into trouble, though. If you get nauseous when your investments go down, you may overreact and sell when you shouldn’t, or make other emotional decisions that are bad for your bottom line. (Sidestepping Pitfalls in Investor Psychology explains several of the psychological mistakes investors make and how you can avoid them.)

By understanding the different types of investments at your disposal, you can invest at a level of risk your stomach can handle. For long-term growth, you can’t beat stocks (Chapter 6). Their higher returns are great for growing your nest egg, but they go hand in hand with the occasional bad year (1929, 2008, and a few others in between). To smooth out stocks’ wild ride, you can also invest in bonds (Chapter 7) and real estate (Chapter 8).

Tip

Investing smaller amounts on a regular schedule (Making the Most of Your 401(k)) improves your results and helps you stop worrying about whether you’re buying at the right time. The technique is called dollar cost averaging, because you automatically buy more shares when the price is lower and fewer shares when the price is higher. The result: a lower average purchase price, which means a higher total return. If you contribute to a 401(k), you’ve been doing it without knowing it.

The key to balancing risk and return is something called asset allocation (Asset Allocation)—how you divvy up your money among different types of investments. More money in stocks means higher risk and higher long-term returns. More in bonds provides less risk and lower returns.

A lot of your investment performance stems from the asset allocation you pick. That means you don’t have to train to be the next Warren Buffett. In fact, once you settle on your asset allocation, your investments don’t need a lot of hand-holding. A handful of index mutual funds apportioned to your asset allocation is all it takes to get started (Asset Allocation Made Ridiculously Easy).

At the same time, you don’t just plop your money into investments and forget about them until it’s time to withdraw some cash. Because stocks, bonds, and other investments grow at different rates, your asset allocation goes out of whack over time. From time to time, you have to rebalance your portfolio to bring your asset allocation back on target (Checking Up on Funds, Stocks, and Bonds). For long-term goals, checking your allocation once a year is usually enough. If the percentages are within 1% or 2%, you can leave things alone until another year passes. When your goals fall in the 5- to 10-year range, a quarterly or semiannual tune-up may be in order.

Sometimes, investments don’t turn out as you hoped. If that happens, it’s time to do some weeding and feeding. Getting rid of “dogs” not only improves your portfolio; it’s another opportunity to bring your asset allocation back on track.

Note

You have to adjust your asset allocation to reduce risk as you get closer to needing money from your investments. That way, your portfolio doesn’t take a big hit just when you plan to take out cash. Managing a Retirement Portfolio tells you how.

One thing that’s impossible to simplify is taxes. The government offers a plethora of tax-advantaged options for retirement, college, and health-care saving. This book helps you decide which types of tax-advantaged accounts (tax-deferred, tax-free, and so on) make sense for you. You’ll also learn which types of investment to put in which types of accounts if you use a combination of taxable and tax-advantaged accounts.

About This Book

These days, bookstores, libraries, and the Web are chock-a-block with financial and investment information. The problem is they’re like a dictionary. How do you find the word you want to spell correctly if you don’t know how to spell it? If you’re trying to learn about investing, how do you sort through thousands of books and web pages to find what you really need to know about your money?

This book takes the place of the manual that should have accompanied your first paycheck (or the first allowance your parents paid you). In these pages, you’ll learn the basics of investing and find step-by-step instructions for using websites to choose the right funds (Chapter 5), stocks (Chapter 6), bonds (Chapter 7), and so on. If you’re just starting out with investing, you can read the first few chapters to learn how to keep investing as simple as possible. After that, you can jump from topic to topic depending on what you want to invest in and the investing task at hand. The book helps you figure out which investments are right for you and the best way to use them.

Tip

Although every year seems to introduce new investment options and tax regulations, this book is a good primer for setting up and managing your investment portfolio. Of course, it’s a good idea to check for changes in government regulations before you make new investments or change the ones you already own.

Personal Investing: The Missing Manual is designed to accommodate readers at several levels of investment knowledge. The primary discussions are written for people with beginner or intermediate investment skills. But if you’re reading about investing for the first time, special boxes with the title “Up To Speed” provide the introductory information you need to understand the topic at hand. On the other hand, people with advanced skills should watch for similar boxes called “Power Users’ Clinic,” which give more technical tips and tricks for more savvy investors.

About the Outline

Personal Investing: The Missing Manual is divided into three parts, each containing several chapters:

Part One: Prepare to Invest gets you started with what you have to do before you get into the nitty-gritty of investing. First, you learn how investing helps you achieve your long-term goals. Before you start investing, you need to know what those goals are. You’ll learn how to identify your goals and then estimate what they’re going to cost. The last chapter explains how to build an investment plan to reach those goals. You’ll also learn to sidestep the psychological mistakes people often make when they invest, so your investments can truly shine.

Part Two: Choose and Buy Your Investments starts with a quick overview of what you can invest in. These chapters then take you through each type of investment, including funds, stocks, bonds, and real estate investment trusts (REITs). The last chapter in this section explains how to keep your investment portfolio in tip-top condition.

Part Three: Manage Your Investments gives you the full scoop on investing for big life goals: retirement, college education, and health care. These chapters start by explaining the special challenges you’ll face. Then, they take you through how to pick the right investments and the right types of accounts. Finally, they explain how to spend the money you’ve worked so hard to put together.

The Very Basics

These days, the Web is a treasure trove of investment information. So, to use this book, you need to know a few computer basics. Web pages and programs like Microsoft Excel respond when you click mouse buttons to choose commands from menus, or press combinations of keys for keyboard shortcuts. Here’s a quick overview of a few terms and concepts this book uses:

Clicking. This book gives you three kinds of instructions that require you to use your computer’s mouse, trackball, or track pad. To click means to point the arrow pointer at something on the screen, and then—without moving the pointer at all—press and release the left button on the mouse (or trackball or laptop track pad). To right-click means the same thing, but using the right mouse button. To double-click, of course, means to click the left button twice in rapid succession, again without moving the pointer at all. And to drag means to move the pointer while holding down the left button the entire time. When you’re told to Shift+click something, you click while pressing the Shift key. Related procedures, such as Ctrl+clicking, work the same way—just click while pressing the corresponding key.

Menus. The menus are the words across the top of your screen: File, Edit, and so on. Click one to make a list of commands appear, as though they’re written on a window shade you’ve just pulled down. Some people click to open a menu, and then release the mouse button; after reading the menu command choices, they click the command they want. Other people like to press the mouse button continuously as they click the menu title and drag down the list to the desired command; only then do they release the mouse button. Either method works, so choose the one you prefer.

Keyboard shortcuts. Nothing is faster than keeping your fingers on your keyboard, entering data, choosing names, triggering commands—without losing time by grabbing the mouse, carefully positioning it, and then choosing a command or list entry. That’s why many experienced Excel fans prefer to trigger commands by pressing combinations of keys on the keyboard. For example, in most word processors, pressing Ctrl+B produces a boldface word. When you read an instruction like “Press Ctrl+C to copy the selection to the Clipboard,” start by pressing the Ctrl key; while it’s down, type the letter C, and then release both keys.

About→These→Arrows

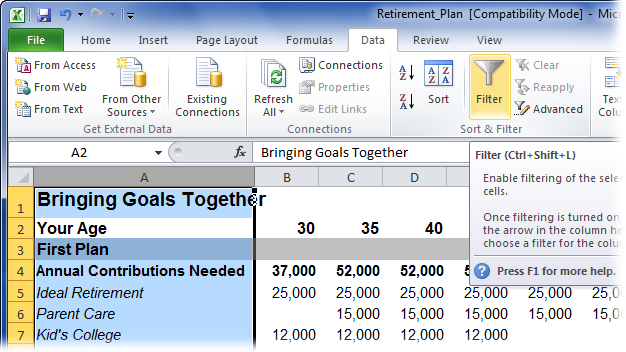

Throughout this book, and throughout the Missing Manual series, you’ll find sentences like this one: Choose Data→Filter→AutoFilter. That’s shorthand for a much longer instruction that directs you to navigate three nested menus in sequence, like this: “Choose Data. On the Data menu, point to the Filter menu entry. On the submenu that appears, choose AutoFilter.”

Programs like Word 2007, Excel 2007, and PowerPoint 2007 use a ribbon instead of a menu bar. The arrow shorthand applies to the ribbon as well. For example, Data→Sort & Filter→Filter is shorthand for selecting the Data tab on the Office ribbon, navigating to the Sort & Filter section, and then clicking Filter, as you can see below.

Similarly, this arrow shorthand also simplifies the instructions for opening nested folders, such as Program Files→Microsoft Office→Office12→1033.

About MissingManuals.com

At http://www.missingmanuals.com, you’ll find news, articles, and updates to the books in this series.

But the website also offers corrections and updates to this book (to see them, click the book’s title, and then click Errata). In fact, you’re invited and encouraged to submit such corrections and updates yourself. In an effort to keep the book as up-to-date and accurate as possible, each time we print more copies of this book, we’ll make any confirmed corrections you suggest. We’ll also note such changes on the website, so that you can mark important corrections into your own copy of the book if you like.

In the meantime, we’d love to hear your suggestions for new books in the Missing Manual line. There’s a place for that on the website, too, as well as a place to sign up for free email notification of new titles in the series.

About the Missing CD

This book helps you invest. As you read through it, you’ll find references to websites that offer additional resources. Each reference includes the site’s URL, but you can save yourself some typing by going to this book’s Missing CD page—it gives you clickable links to all the sites mentioned here. To get to the Missing CD page, go to the Missing Manuals home page (www.missingmanuals.com), click the Missing CD link, scroll down to Personal Investing: The Missing Manual, and then click the link labeled “Missing CD”.

Safari® Books Online

Safari® Books Online is an on-demand digital library that lets you easily search over 7,500 technology and creative reference books and videos to find the answers you need quickly.

With a subscription, you can read any page and watch any video from our library online. Read books on your cellphone and mobile devices. Access new titles before they’re available for print, and get exclusive access to manuscripts in development and post feedback for the authors. Copy and paste code samples, organize your favorites, download chapters, bookmark key sections, create notes, print out pages, and benefit from tons of other time-saving features.

O’Reilly Media has uploaded this book to the Safari Books Online service. To have full digital access to this book and others on similar topics from O’Reilly and other publishers, sign up for free at http://my.safaribooksonline.com.

Get Personal Investing: The Missing Manual now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.