Chapter 4. How Investments Work

During your lifetime, you invest in a lot of things: a college education, financial investments, or a long-term relationship. In every case, you expect some kind of payback in return, whether it’s a good paycheck, savings to support you during retirement, or someone to hold your hand at the movies.

You know that life can be a bit of a gamble. The higher you aim, the higher the risk of failure. The same holds true for investments; the ones with the highest returns also come with the greatest risk that you may lose money. Investments with lower average returns tend to be safer, but don’t help your portfolio grow as much. So, when you invest, you perform a balancing act between earning high enough returns to reach your financial goals and limiting the risk you face.

This chapter starts with an introduction to the four main types of investments. You’ll learn how each one works, why they produce the returns they do, and the level of risk each one presents. Because investment returns are so important, you don’t want to give them up needlessly. That’s why this chapter also talks about how the government taxes your investments, and how you can keep those taxes from eating up your returns.

The Big Four: Typical Investments

Although the financial world is as rife with exotic investments as a cafe is with fancy coffees, most people do just fine choosing from four basic types of investments (funds, stocks, bonds, and real estate). In fact, with the right fund, you can purchase one investment (the fund) and let the fund manager take care of purchasing the other types of investments (because some funds put money into a smorgasbord of investments). Even so, to make sure you’re getting the combination of returns and risk you’ve decided on (Return vs. Risk), you need to understand the four investment types.

Note

When you know which types of investment you’re interested in, you can jump to one of the other chapters in this book to learn more:

Chapter 5 gives you the full scoop on the type of investment almost everyone owns: funds. You’ll learn about index funds, actively managed funds, exchange-traded funds, and more.

Chapter 6 talks about how to evaluate stocks.

You can learn about how to invest in bonds and the difference between bonds and bond funds in Chapter 7.

Chapter 8 shows you how to dive into real estate with real estate investment trusts.

Stock: Owning Part of a Company

A share of stock is just that—a share of ownership in a business, whether it’s your own, a friend’s, or a publicly traded corporation’s, like Google. (You may see these investments referred to as stocks, common stocks, equities, or shares.) The business’s performance has a lot to do with whether its share price goes up or down. So does investors’ opinion of the company’s prospects; it determines whether they’ll pay more or less for the stock.

You make money when the share price goes up (the increase in value is called a capital gain)—although the money doesn’t land in your hot little hands until you actually sell your share. You can also earn money on stock through dividends, a payment of part of the company’s profits to shareholders, which you’ll learn about shortly.

If a company’s products or services are on everyone’s must-have list, sales and earnings usually rise. Investors want a piece of the action, so they bid more for shares, which sends the share price higher. For example, when Google went public, one share of its stock sold for about $108. In February 2010, the share price was around $540, about five times the original price.

Although Google’s stock looks like a tremendous success story, you can see below that the trip Google’s share price took wasn’t a straight line. Owning stock has the potential to deliver attractive returns, as Google’s stock shows. Between 1926 and 2009, stocks returned about 11% a year on average (assuming dividends were reinvested in stock).

However, higher stock returns come with higher risk. In any 1 year, the overall return for stocks could be just about anything. The highest 1-year increase—of 54%—occurred in 1933. The largest 1-year drop, 43.3%, was 2 years earlier, in 1931. This potential for wild gyrations is the reason you invest in stocks for long-term, not short-term, goals, as you’ll learn on Return vs. Risk.

On the other hand, Enron, an electric and natural gas utility company, shows the worst case when investing in stocks. The company saw its stock go from $90 per share to $0 when the company went bankrupt. Although Enron is an extreme example, if investors suspect trouble (like products becoming obsolete, increased competition, decreasing earnings, losses, and so on), they bid less for shares, lowering the stock price.

Note

If a company goes bankrupt, it pays off its debts and other liabilities first. If there’s any money left over, it goes to shareholders. (Bond Credit Quality explains the hierarchy of payouts when a company goes out of business.)

Many companies reinvest their profits back into the company. That way, they grow their businesses without borrowing or issuing more shares. But at some point, a company might run out of productive uses for its profits. Then it might pay out some of those profits as dividends to shareholders. Most investors view regularly increasing dividends as a sign of a company’s financial strength. (On the other hand, if a company reduces its dividend payment, the share price usually drops as well, because investors worry that the company is struggling.)

Note

Cash dividends often add a bit of stability to share price, because the dividend acts like a foundation for the price. A dividend paid by a stock is similar to a yield earned on a savings account. (You calculate the yield by dividing the dividend payout by the share price.) Unlike a savings account, the dividend yield increases as the stock price goes down. If the dividend yield goes high enough, the stock becomes an attractive investment for the yield alone.

Bonds: Lending Money

A bond is like a loan you make to a company or to the government (both known as the bond issuer). In return for the use of your money, the issuer pays you interest on a regular schedule. Then, when the bond matures (that is, when the loan comes due, usually between 1 and 30 years), the issuer gives you your original investment (your principal) back.

Many investors buy bonds for the interest they pay. For example, retirees often use bond income to cover part of their living expenses. The interest rate a bond pays doesn’t change once the bond is issued. Even if the company that issues the bond does spectacularly well, you still earn the original interest rate. For example, a $1,000 bond with a 6% interest rate pays $60 in interest each year until the bond matures. That’s one attraction of buying and holding a bond: Your return may be lower than what you’d earn from investing in stock, but you know what your return will be all along.

Although most investors stick with bonds purely as income investments, you can make money with bonds in another way. Although a bond’s interest rate doesn’t change, its price can. For example, if market interest rates go up, the bond price goes down. (Understanding Bond Prices explains why this happens.) But if interest rates go down, the bond price goes up. If you sell a bond before it matures for more than you paid for it, you earn a capital gain, just as you do when you sell a share of stock for more than you paid.

The reason bond prices change in response to market interest rates is competition, plain and simple. If you buy a $1,000 bond that pays 4% interest, you get $40 a year in interest. If a new bond comes out that pays 5% interest ($50 a year), why would anyone want to pay full price for your bond? To make your bond competitive, you have to drop its price so the new owner earns 5% interest. In this example, you’d have to sell your $1,000 bond for $800. (There’s more to bond prices than that, as you’ll learn starting on Understanding Bond Prices.)

Bonds are much less risky than stocks if you hold them until they mature, because you get back their face value regardless of the state of the market. In fact, bonds aren’t as risky as stocks even if the issuer gets into trouble. As you see on Bond Credit Quality, bondholders get repaid before stock shareholders if a company goes out of business. Credit quality is one way to gauge how much risk you take investing in a bond (based on the risk of the issuer missing interest payments or not paying back principal). You’ll learn how to evaluate bonds and their risks in Chapter 7.

Investing with Others: Funds

If you don’t have a lot of money to invest, it’s tough to build a diversified portfolio of individual stocks and bonds. There’s also the issue of time spent figuring out which stocks and bonds to buy and keeping an eye on them to make sure they perform the way you expect. Finally, you may simply worry that you don’t know enough to get everything right (Which Type of Investor Are You?). The solution for many people is funds, whether they’re mutual funds, exchange-traded funds, or more exotic varieties.

When you buy shares in a fund, the fund company tosses your cash in the same pot with the money from other people and then uses that money to buy a bunch of stocks, bonds, other types of investments, or some combination of different types of investments.

Funds have become the odds-on favorite with lots of investors for several reasons:

Diversification. In many cases, as little as $1,000 gets you the diversification you need to keep your risk at a level you can live with.

Ease of use. Choosing a fund doesn’t take as much time or effort as picking a stock or bond, as Chapter 5 explains. In addition, the fund’s managers do the heavy lifting in research and investment decisions, so you don’t have to spend as much time making sure your investments are performing up to your expectations.

Market focus. Once you decide what part of the market you want to invest in (Asset Allocation), you can find funds that cover it. Stocks? Bonds? Tiny companies? Asian companies? Companies that are socially responsible? You can find a fund that focuses on each of those investments. Among the thousands of funds in the United States, you can find funds that cover the entire investment world or funds that invest in only a few dozen stocks.

Index funds are so named because they mimic a market index (a collection of investments that represents a market segment; the S&P 500, for example, is an index of the stocks of the country’s biggest companies, while the Barclays Aggregate Bond Index is a broad bond market index). They’re the easiest and most cost-effective way to invest in funds. Although index funds still have fund managers, the funds practically run themselves, because they invest in whatever the index is made up of. If the S&P 500 drops a company from its list, an S&P 500 index fund does, too.

Because of the way they invest, index funds don’t have to pay fund managers big salaries, and they don’t have to buy and sell holdings often. For both those reasons, index fund expenses are some of the lowest you’ll find (on average, about 0.25% per year).

In contrast to index funds, actively managed funds mean someone’s actively making investment decisions about what to buy, sell, or hold onto. Actively managed funds try all sorts of strategies to earn above-market-average returns: picking stocks, investing in specific industries, and so on. However, over the long term, most actively managed funds end up nose to nose with the market average. That matching performance, combined with higher fund expenses for actively managed funds, is the reason index funds usually make more sense, as you’ll see shortly.

Note

A relative newcomer to the investment scene is the exchange-traded fund (ETF). An ETF can be an index fund or an actively managed fund. It pools investors’ money like a mutual fund does, but you can buy or sell shares in an ETF anytime you want, just as you can with a stock. Exchange-Traded Funds gives you the full scoop.

It’s no surprise that you have to pay someone else to do mutual fund investment work, like researching investments and making buy and sell decisions. Unlike with stocks and bonds, where you pay commission only when you buy or sell, mutual funds charge ongoing fees and expenses.

Just like inflation, mutual fund expenses might not sound like much, but those expenses directly affect your investment returns. Whether the fees are out of this world, like 2% per year for some actively managed funds, or the frugal 0.2% some index funds charge, those expenses reduce the return you receive. For example, say you have $10,000 in a mutual fund and the fund returns 6% in 1 year ($600). However, the fund has a 1% expense ratio (the annual cost for managing and running the fund). You pay $100 per year in expenses, so your fund investment nets only $500, or 5%, that year.

As you learned on Why Scary Numbers Aren’t That Scary, a 1% difference in return (say from 6% to 5%) over decades makes a ginormous difference in the size of your portfolio. Because actively managed funds charge higher expense ratios, they have to deliver higher returns just to stay even with the market average. And because they typically don’t manage to do that over time, most actively managed funds can’t keep up with their index fund counterparts.

Note

Keeping a Lid on Fund Expenses tells you all about the different types of expenses that mutual funds charge, how much they charge, and how to decide when enough is too much.

Real Estate Investment Trusts (REITs)

If you want to diversify your portfolio beyond stocks and bonds, real estate is another option. Because most people can’t afford to invest in individual properties, real estate investment trusts (REITs) are the answer. These companies invest in the real estate market, so you can buy shares in a REIT on a stock exchange and immediately own a slice of hundreds of properties. You don’t have to play landlord or wait months to sell a building you own directly. Some REITs invest in real estate mortgages, which means they lend money to companies to buy real estate. Chapter 8 tells you how to invest in REITs.

Note

REIT mutual funds or REIT ETFs purchase several individual REITs, which gives you even more diversification.

By law, REITs pay out 90% of their income to shareholders, so their dividends (5%, 6%, or more per year) are attractive to income investors. However, REIT dividends are taxed as ordinary income, which is a higher tax rate than what you pay on stock dividends, so REITs are best held in a non-taxed account (Is REIT Investing Right for Me?).

A REIT’s share price can increase, too, if its earnings or the value of its properties increases. Of course, what goes up can also come down, which was true of many REITs during the recent real estate market debacle.

Putting all your eggs in one basket is never a good idea. REITs let you diversify by owning many properties. With REITs, you can also diversify by geographic location or by type of property, such as shopping malls, apartment buildings, condos, office buildings, hotels, resorts, storage facilities, industrial parks, and health-related facilities.

Taxing Decisions

Every tax season, the federal and state governments wait impatiently for their tax fix from the money you make, whether it comes from your salary, poker winnings, or earnings from your investments. Paying taxes on investment gains and income hurts, because you’re handing over money that would otherwise be compounding like crazy to help you reach your financial goals (Why Scary Numbers Aren’t That Scary).

Because retirement, college education, and health care are so important, you can get some tax relief by putting money for those goals into several types of government-sponsored tax-advantaged accounts (a fancy name for accounts that give you some kind of tax break). Even if you invest in taxable investments, you can minimize your tax bill by allocating those investments carefully between taxable and tax-advantaged accounts. In other words, put your most taxable investments in tax-advantaged accounts, and put investments with the smallest tax bills in your taxable accounts.

Note

The following chapters give you the full scoop on tax-advantaged accounts for long-term goals:

Chapter 10 covers retirement investment accounts.

Chapter 11 discusses options for saving for college.

Chapter 12 talks about how to save for health care.

You’ll see why paying attention to taxes is important below. Then you’ll get an introduction to the different types of tax-advantaged accounts available. And finally, you’ll learn the pros and cons of putting specific types of investments in tax-advantaged and taxable accounts.

The Big Tax Bite

In Chapter 1, you learned why you need the higher returns that investing provides to beat inflation and reach your financial goals. But just when you thought you had the inflation problem licked, you realize that taxes nibble away at your nest egg like money-eating piranhas.

Bonds and REITs deliver lower long-term returns than stocks do (Return vs. Risk), and then, to make matters worse, returns from them get taxed as ordinary income—at the highest tax rate you pay, in other words. Long-term capital gains (like those you get when you sell a stock after holding it for more than a year) and stock dividends deliver higher long-term returns and have the additional advantage of a lower tax rate.

The table below summarizes tax rates for different types of investment returns for someone in the 25% tax bracket (with a taxable income of between $33,950 and $82,250).

Investment return | Tax rate |

Ordinary income: 25% | |

REIT dividends | Ordinary income: 25% |

Stock dividends | 15% (5% for people in the 10% or 15% tax bracket) |

Ordinary income: 25% | |

15% (0% for people in the 10% or 15% tax bracket) |

Note

Mutual funds distribute interest, dividends, and capital gains that their underlying investments produce during a year. If you hold mutual funds in a taxable account, you have to pay taxes on those distributions as if you owned the individual securities. Mutual funds that don’t buy and sell frequently, such as index funds, don’t generate as much in capital gains, which reduces the capital gains taxes you owe (The Big Tax Bite).

Although 2010 tax rates are as low as rates have been in years, even relatively benign tax rates dramatically reduce your investment results. Here’s an example:

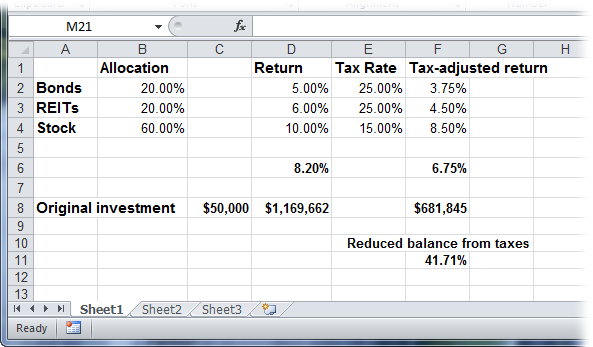

Say you’re single and make $50,000 a year, which puts you in the 25% tax bracket.

You invest $50,000 in one lump sum, allocated to 60% stocks, 20% bonds, and 20% REITs.

Assume that stock dividends and capital gains provide a total return of 10%; your bonds pay 5%; and your REITs return 6%.

Other than rebalancing your portfolio to maintain the percentages in each type of investment, you let your portfolio grow for 40 years.

The table below shows that taxes reduce your overall return from 8.2% to 6.75% per year. That doesn’t sound like much, but over 40 years, that smaller return cuts your retirement portfolio by about 40%, from $1,169,662 to $681,845.

Making the Most of Tax-Advantaged Accounts

Tax-advantaged accounts come with a variety of features, but the most common characteristic is delaying the time when you have to pay taxes. Tax-deferred means your money can grow unfettered by taxes, which come due only when you withdraw from the account. You can reinvest the full amount of interest, dividends, and capital gains you earn to compound for years without a dollar going to taxes. Only when you withdraw money during retirement do you pay taxes; at that time, your tax rate might be lower.

Chapters Chapter 10, Chapter 11, and Chapter 12 give you the full rundown on different types of tax-advantaged accounts, but here’s a quick introduction:

401(k) and 403(b). These tax-deferred accounts (Making the Most of Your 401(k)) have become the mainstay for employer-sponsored retirement savings, with the majority of employers choosing to offer them over traditional pension plans. You contribute a percentage of your paycheck before paying taxes on it, so your tax savings reduce how much you pay out of pocket for your contribution. For example, if you’re in the 25% tax bracket and contribute $10,000 to your 401(k) or 403(b), you save $2,500 in taxes, so your net out of pocket is only $7,500.

In 2010, the maximum annual contribution is $16,500. (If you’re over 50, you can add a catch-up contribution of up to $5,500.) You must start withdrawing from your account when you’re 70 ½.

Tip

If your company matches a portion of what you contribute, that match is like an immediate 100% return on the portion the company matches. It’s unlikely you’ll find a return that good elsewhere, so if you can’t afford to contribute the maximum amount to your 401(k), at the least, contribute enough to get the full company match.

Traditional IRA. Anyone with earned income (salary, wages, tips, bonuses, and so on) can contribute to a traditional IRA, another tax-deferred account option. If you’ve contributed the maximum to your 401(k) or 403(b), a traditional IRA is one way to get more money into retirement savings. In 2010, you can contribute up to $5,000 (plus an additional $1,000 catch-up contribution if you’re over 50). Your contributions might be tax-deductible depending on your income. For example, if you’re single and your adjusted gross income is less than $56,000, your entire contribution is tax deductible.

You must be younger than 70 ½ and have earned income to contribute to a traditional IRA. As with 401(k) plans, you must start withdrawing when you reach age 70 ½.

Roth IRA. Similar to traditional IRAs, 401(k)s, and 403(b)s, you don’t pay taxes on interest, dividends, and capital gains in a Roth IRA (Roth IRA). What gets everyone’s attention is that you withdraw from these accounts tax-free after the age of 59 ½. The catch is that contributions to a Roth IRA aren’t tax deductible. That is, you pay taxes on the money before you contribute to the account. With some income limitations, Roths have the same contribution and catch-up limits as traditional IRAs.

Roth IRAs have other features that make them attractive for saving for your later retirement years. You can continue to contribute after you reach 70 ½, and there’s no mandatory annual distribution at any time. Because you contribute after-tax money, you can withdraw your contributions at any time without paying taxes or penalties.

Roth conversion. If you convert a traditional or rollover IRA to a Roth IRA, you have to pay taxes on the tax-deferred contributions you made to the original account. Should I Convert a Traditional IRA to a Roth IRA? helps you decide whether a conversion makes sense for you.

Inherited IRA. A beneficiary of an IRA can transfer the money into an inherited IRA to keep the tax-deferral going until the IRS requires distribution. The tax rules for inherited IRAs make Einstein’s theory of relativity look like a piece of cake, so consulting a tax advisor is a good idea if you inherit an IRA.

SEP-IRA. For small businesses or self-employed individuals, the simplified employee pension IRA (SEP-IRA) is the easiest pension plan option. You can contribute up to 25% of your income each year (to a maximum $49,000 in 2010). You can set up a SEP-IRA for a side business even if you already have a 401(k) at your day job.

Note

See Retirement Plans for Small Businesses to learn about other retirement account options for small businesses, such as Keogh and SIMPLE plans.

Section 529 college savings plan. Investments grow tax-deferred in these popular college savings plans. Withdrawals are tax-free as long as you use them for qualified educational expenses (Section 529 Savings Plans). The contribution limits are high, sometimes as much as $300,000. Whoever contributes to the account is the owner, who can then name a family member as the beneficiary. That’s good news for two reasons. First, colleges don’t take the 529 investment into account when they calculate a student’s financial aid, because the account isn’t in the student’s name. Second, if the current 529 beneficiary ends up getting a big scholarship, you can change the beneficiary.

Section 529 college prepaid plan. Prepaid plans lock in future tuition costs at today’s rates (Section 529 Prepaid Plans). They aren’t as popular as 529 savings plans, because they make it harder to roll over into another plan or switch to another beneficiary.

Coverdell education savings account. Investments in these accounts grow tax-deferred, and withdrawals are tax-free if you use them for qualified educational expenses. The big drawback to these accounts is the $2,000 annual contribution limit, a drop in the bucket for college costs.

Health savings account. If you have a high-deductible health insurance plan, you can set up a health savings account (HSA), described in detail on High-Deductible Health Insurance Plans. In 2010, an individual can contribute up to $3,050 pre-tax with a $1,000 catch-up if you’re 55 or older. Unlike with flexible spending accounts, you don’t have to use the money you contribute during a specific year. You can invest the money in the same kinds of options you have with an IRA. Withdrawals for health care are tax-free.

Tax-Advantaged or Taxable: Where to Put Investments

Tax-advantaged accounts limit how much you can contribute each year. If you’re saving for a goal that has tax-advantaged account options (retirement, college, and health care), rule number one is to contribute as much as you can to these accounts before you contribute to taxable accounts.

After that, you have some decisions to make about which investments to keep in tax-advantaged and taxable accounts. In short, keep investments with the highest tax bills in your tax-advantaged accounts and those with lower tax bills in taxable accounts.

Note

The ultimate investment savings comes, sadly, when you die. Your beneficiaries inherit the stock you owned on a stepped-up basis, which means that they inherit it as though they paid market value for the investment on the date of your death. That means your beneficiaries don’t have to pay capital gains on the increase in the stock’s value that occurred during your lifetime.

As you learned on The Big Tax Bite, the tax rates on interest income, dividends, and capital gains vary and depend on the type of investment and how long you hold it. The table below shows you which types of investments are better in tax-advantaged and taxable accounts from a tax perspective—if you have a choice of accounts.

Investment type | Investments to hold in a tax-advantaged account | Investments to hold in a taxable account |

Stock funds that pay high dividends (because the dividends are taxable). High-turnover (Keeping a Lid on Fund Expenses) funds (they produce capital gains, and short-term capital gains in particular), as fund managers trade investments. The gains are taxed at ordinary income rates. Mutual funds, because their managers have to sell shares to meet redemption requests, generating capital-gains taxes. | Stock funds that pay low or no dividends. Low-turnover stock funds, such as index funds. ETFs, which don’t have to sell investments to meet redemption requests the way mutual funds do. Tax-managed funds, which invest with an eye toward reducing taxes. | |

Stocks that pay high-dividends, which are taxable. Stocks you trade frequently, which results in capital gains. | Stocks with low or no dividends. Stocks you tend to buy and hold onto, because you don’t pay capital gains until you sell, and then they’re long-term capital gains. | |

Regular bonds and high-yield bonds, because they produce current income taxed at ordinary income-tax rates. | Municipal bonds and bond funds; the federal government doesn’t tax income (nor does the state tax bonds if you buy state-issued bonds in the state where you live). | |

REITs tend to pay attractive dividend rates, and their income is taxed at ordinary income tax rates. |

Managing Taxes in Taxable Accounts

Sometimes, you have to put higher-taxed investments into taxable accounts. For example, if you’re saving for a short-term goal, stocks may be too risky, so you put your money in bonds or bond funds, or in a savings account. Or you may be saving for a goal that doesn’t have a tax-advantaged account option. Don’t worry. Although you shouldn’t make investment decisions purely to avoid paying taxes, you can keep your investment taxes low with the following tactics:

Buy and hold individual stocks and bonds instead of stock or bond funds. You don’t pay capital gains on individual stocks and bonds until you sell them; fund managers may trade within stock or bond funds frequently, and you pay taxes on any gains from those trades. Sell individual securities in taxable accounts only to rebalance your asset allocation or because an investment hasn’t panned out as you hoped.

Buy municipal-bond funds or municipal bonds. If you want more bonds in a taxable account, purchase municipal bond funds. The federal government doesn’t tax municipal bond income. In addition, you don’t pay state taxes on municipal bond income if you buy municipal bonds issued by your state.

Delay selling until the capital gains are long term. If you sell an investment before you own it for a year, you earn a short-term capital gain, which is taxed at ordinary income rates (for someone in the 25% tax bracket, that rate is 25%, versus the 15% for long-term capital gains). If you’re close to the 1-year mark and the investment isn’t in mortal danger, hold off on the sale until you pass the 1-year mark.

Wait until the next calendar year to sell. If the end of the year is close, delay a sale until January. That way, you don’t pay tax on the capital gain until the following year, which means you have a full year to use that money, for example, to earn interest on savings or invest in something else.

Offset capital gains with capital losses. If you have capital gains and also have some losers you want to unload, sell the losers in the same tax year as the winners. Your capital losses offset your capital gains. This tactic is particularly effective for short-term capital gains, taxed at higher, ordinary income rates.

Note

If you have more than $3,000 in long-term capital losses, you can use those losses to offset long-term capital gains. However, if you don’t have enough long-term capital gains to offset all of your long-term capital losses, you can deduct no more than $3,000 of a long-term capital loss in one tax year and must carry the remaining loss over to future tax years.

Get Personal Investing: The Missing Manual now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.