CHAPTER 12

Capital Modeling

In this chapter, we will explore the various methods for calculation operational risk capital and the challenges faced in adopting the advanced measurement approach. Different capital modeling methods are discussed and compared and the use importance of correlation and insurance offsets are considered. Finally, the disclosure requirements are introduced.

OPERATIONAL RISK CAPITAL

Firms that are required to, or that choose to calculate operational risk capital can select from several methods.

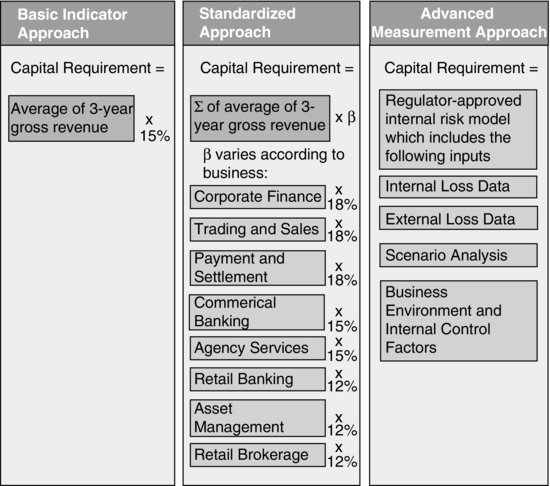

Basel II provides three main approaches to calculating operational risk capital: the basic approach, the standardized approach, and the advanced Measurement Approach (AMA) (see Figure 12.1).

FIGURE 12.1 The Three Basel II Operational Risk Capital Methods

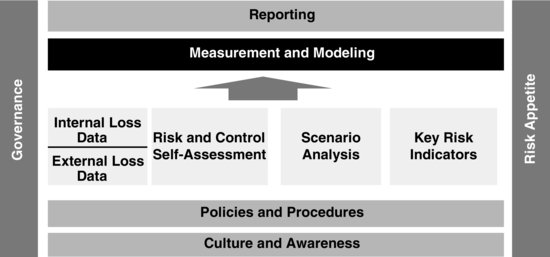

If an AMA is being used, then calculation will draw on the underlying elements, as is illustrated in Figure 12.2. If a simpler approach is being used, then the underlying elements need not feed into the model.

FIGURE 12.2 The Role of Capital Modeling in the Operational Risk Framework

Under the Basel II rules banks are encouraged to move toward the more sophisticated approaches as they develop their operational risk management tools. Basel II expects international active banks to select either the standardized or ...

Get Operational Risk Management: A Complete Guide to a Successful Operational Risk Framework now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.