Chapter 9

Condor Spreads

Acondor spread is used when the trader expects the stock or index to trade within a sideways or slowly trending channel over the life of the trade. The condor’s profitability is driven by time decay’s effect on the two spreads as time passes and the stock or index price remains within the channel formed by the two vertical spreads. A condor spread can be created with call or put options, or both in the case of the iron condor spread.

THE BASIC CONDOR SPREAD

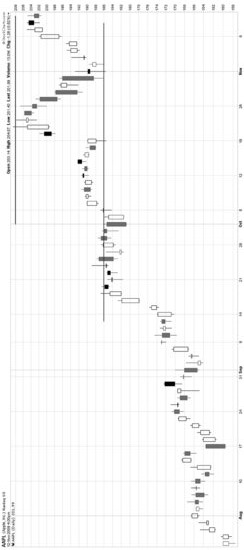

The trader establishes a condor spread when he opens two vertical spreads and positions one down below the current stock or index price and one up above the current stock or index price. In Figure 9.1, the price chart for Apple Computer (AAPL) is displayed as of November 12, 2009. I drew the horizontal support and resistance lines at $186 and $208.

FIGURE 9.1 AAPL Price Chart

Source: Screenshot provided courtesy of StockCharts.com © 2010. All rights reserved.

AAPL traded sideways in a range of approximately $182 to $188 in late September before decisively breaking through on October 6. But notice how AAPL traded down to $186 on October 19 before breaking out to form a new high at about $208 on October 23 and 24. Then AAPL traded back down and touched support at $186 three days in succession in late October and early November. If you were looking at this price chart you might very logically predict ...