Chapter 33

Accounting Depreciation Functions

Wikipedia defines depreciation as “a term used in accounting, economics, and finance to spread the cost of an asset over the span of several years.” Excel has a number of these functions as part of its financial functions. All these function have similar features: initial cost, salvage value, and the numbers of years. This chapter will cover only two functions: the Straight Line Depreciation, SLD, and the Sum of the Years Digits, SYD. The first function is a simple depreciation method and the second one is an accelerated one.

SLD STRAIGHT LINE DEPRECIATION

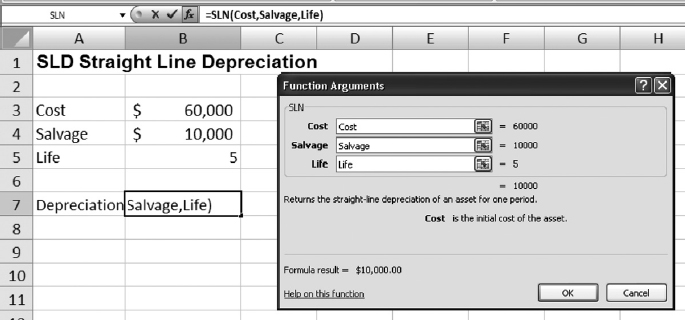

This function assumes the same, or a uniform, depreciation rate for all of the years of the economic life of the asset. For example if the initial value of the asset is $60,000 and the salvage value five years later is $10,000, then the annual depreciation would be $10,000 [(60,000–10,000)/5]. The following is the syntax of the Straight Line Depreciation function:

SLN (cost, salvage, life)

The function is shown in Figure 33.1. The depreciation is $10,000 per year for the lifetime of the asset.

FIGURE 33.1 Straight Line Depreciation

SYD SUM OF THE YEARS DIGITS

Sum of the Years Digits ...

Get Next Generation Excel: Modeling In Excel For Analysts And MBAs (For MS Windows And Mac OS), 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.