12.5. Tech Hall of Shame

We've pinned part of the blame for the meltdown on three technological screw-ups:

One of omission—a lack of transparency that let the problem be ignored for too long.

And two of commission:

Creation of excessively complex, nearly incomprehensible derivative securities.

Creation of even more complex, more incomprehensible pricing models, driven by the wrong data.

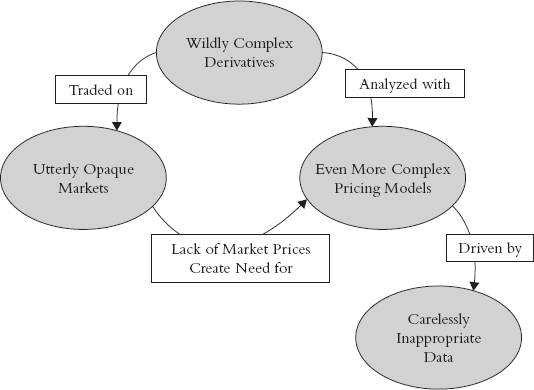

Figure 12.10. An interconnected structure for disaster: uses and abuses of technology in bringing on the Great Mess of '08. There are many other causes, over-leverage, moral hazard ("heads, I win, tails, you lose"), and heads in the sand. These are the ones that involve wires.

Figure 12.10 shows the vicious circle of financial technology errors that contributed to our sorry situation today—the design of monstrously complex incomprehensible derivatives, which then required monstrously complex valuation models, since there was no transparent market to provide this information.

This is far from a complete picture, as it omits reckless rating behavior, AWOL regulation, head-in-the-sand management, and transfer of risk from those who created it to one counterparty and then the next, and ultimately to all of us.

Get Nerds on Wall Street: Math, Machines, and Wired Markets now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.