Chapter 18International Capital Markets

Toto, I have a feeling we're not in Kansas anymore.

— Dorothy, in The Wizard of Oz

Capital markets are markets for long-term assets, with maturities greater than one year. The two most important capital markets are the markets for publicly traded stocks and bonds. Investments in internationally traded stocks and bonds are attractive for two reasons. First, international diversification results in lower portfolio risk than purely domestic diversification because of the relatively low correlations among national market returns. Second, although much of the world's wealth resides in developed markets, emerging markets may be more likely than developed markets to experience economic growth.

18.1 Domestic and International Capital Markets

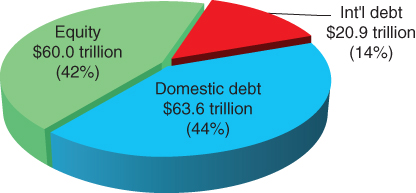

As shown in Exhibit 18.1, the amount of outstanding debt securities slightly exceeds that of outstanding equity securities. Governments are the most active issuers of international debt, whereas financial institutions such as commercial banks are the most active issuers of domestic debt. The growth in market value or market cap (capitalization) of domestic and international debt and equity markets has followed along with economic growth.

Exhibit 18.1 Publicly Traded Debt and Equity Securities ($ trillions)

Source: Debt values are from the BIS Quarterly Review, September 2015, Bank for International Settlements ...

Get Multinational Finance, 6th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.