Chapter 5

Graphical Portfolio Analysis

Markowitz portfolio analysis is a mathematical procedure to determine the optimum portfolios in which to invest. The procedure was first made public in 1952 by HarryMarkowitz.1 The theory caused a profound scientific revolution in finance. Before Markowitz's scientific procedure, investment counselors passed off commonsense guidelines to their clients and pretended it was valuable expert advice—and, unfortunately, many still do.

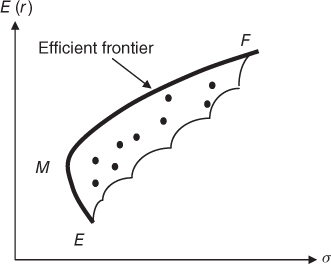

The objective of portfolio analysis is to find the set of efficient portfolios. Efficient portfolios:

- Have the greatest expected return for a given level of risk, or, conversely,

- Offer the lowest risk for a given level of expected return.

The collection of all the efficient portfolios comprises a curve in risk-return space called the efficient frontier. In terms of Figure 5.1, the objective is to find the heavy dark curve from E to F—the efficient frontier—from some opportunity set of potential investments (individual stocks, bonds, and other assets).

Figure 5.1 The Opportunity Set in ![]() Space

Space

5.1 Delineating Efficient Portfolios

There are three methods of solving for the efficient set:

For any given set of candidate assets, all three algorithms will ...

Get Modern Portfolio Theory: Foundations, Analysis, and New Developments, + Website now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.