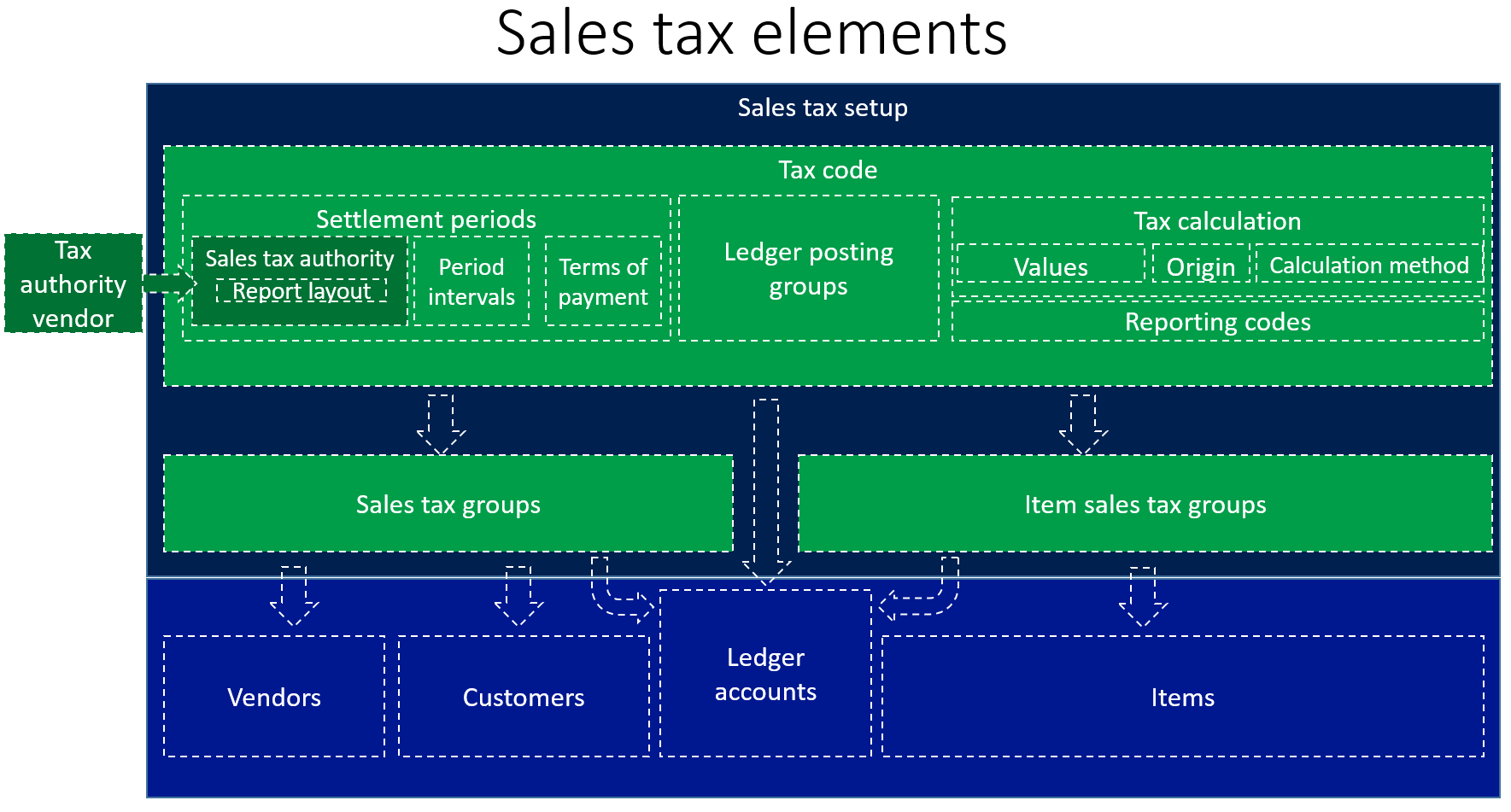

At the heart of sales tax is sales tax code. It carries settlement periods, ledger posting groups, and tax calculations. The settlement periods contain settlement period intervals, terms of payment, and optionally, the vendor ID, which represents the sales tax authority. Then, there are two main groups where the tax code is attached. The first is the sales tax group, which is assigned to vendors, customers, or ledger accounts. The second group is the item sales tax group, which is assigned to items or ledger accounts.

The following diagram illustrates the sales tax elements:

To create a sales tax authority, go to ...